Question: How can I modernize my customer interactions without sacrificing accuracy and security in the automotive lending industry?

Salient

If you're looking to modernize customer interactions in the automotive lending industry without compromising on accuracy and security, Salient could be the perfect fit. Salient is an AI-powered information retrieval system that helps you improve customer interactions by automating important conversations like welcome calls, inbound calls, and early delinquency calls. It integrates with existing tools, spans multiple channels, and is secure with SOC 2 and PCI L1 certifications. The platform can be deployed on-premises for maximum control, so you can free up your staff to focus on higher-value work while maintaining accuracy and security.

Sierra

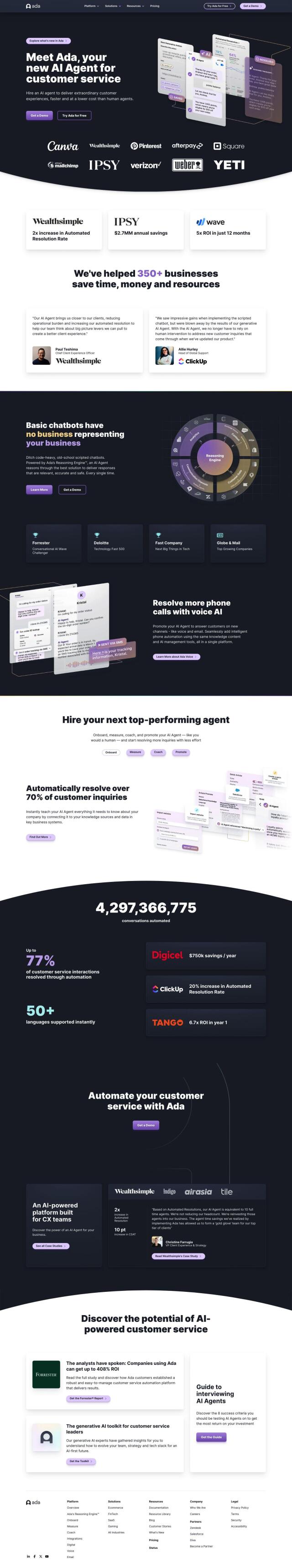

Another top contender is Sierra, a conversational AI platform that's built on a foundation of security, compliance, and trust. Sierra lets you deploy AI agents that mirror your brand's tone and voice, engage customers in natural conversations, and resolve issues in real time. The platform continually refines customer experiences through analytics and reporting and integrates with existing systems of record. With real-time monitoring, quality assurance workflows, and data governance, Sierra ensures data privacy and integrity, making it a great option for improving customer satisfaction and maintaining compliance in the automotive lending industry.

boost.ai

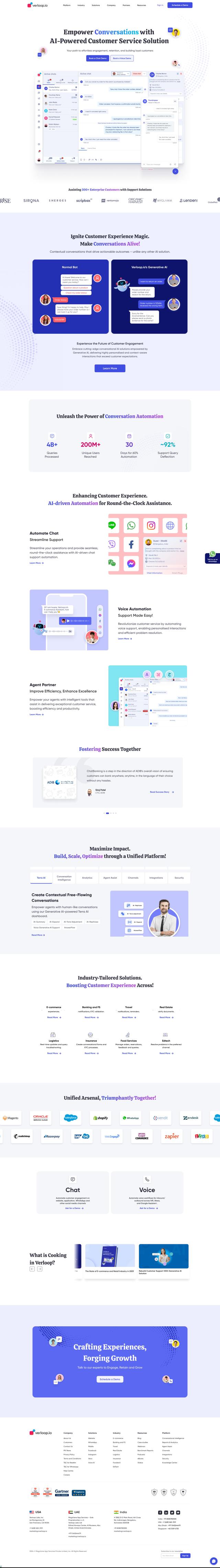

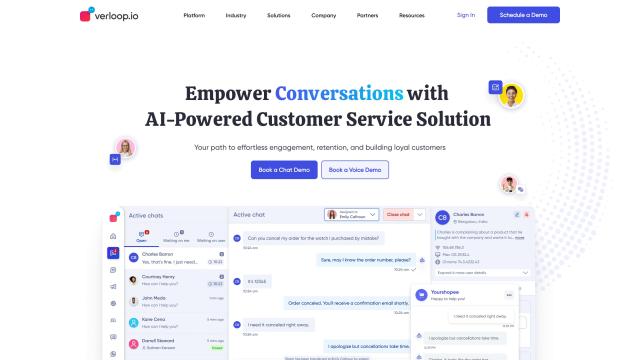

For a scalable and secure option, check out boost.ai, an enterprise-ready conversational AI platform. It uses AI chat and voice bots to deliver personalized interactions with customers, can handle high volumes of traffic, and integrates with existing systems. The platform offers omnichannel consistency, 24/7 coverage, and a hybrid approach blending human and virtual agents. With no-code functionality and a ROI-focused approach, boost.ai is designed to drive self-service rates across channels while maintaining high-quality interactions.

LivePerson

Last but not least, LivePerson provides a powerful conversational AI platform that helps businesses transition to digital-first customer interactions. It enhances engagement and results by routing voice calls to digital channels, automating common customer intents, and analyzing omnichannel conversation data to understand customer needs. LivePerson is highly customizable, reducing operating costs by 30% while improving customer satisfaction by 10%, so it's a great option for modernizing your contact center with minimal disruption.