Treasure Data

If you're looking for a Sensibill alternative, Treasure Data is a good option. It's a customer data platform (CDP) that's a Gartner leader and offers the ability to create a single customer profile from historical and real-time data. The company's platform is geared for enterprise-scale businesses and is designed to help break down data silos, improve sales and operational efficiency and deliver personalized customer experiences. It offers strong data governance and programs to drive business growth, making it a good option for financial services companies.

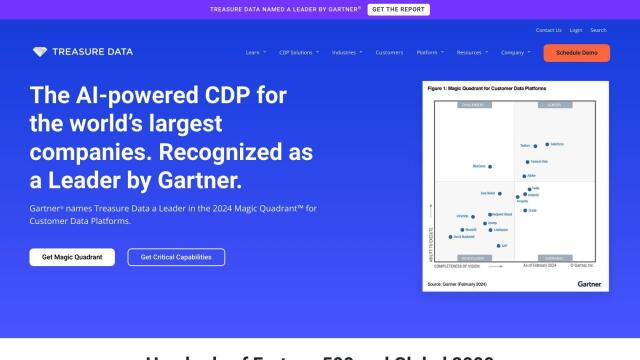

Amperity

Another good option is Amperity, a CDP that helps companies achieve customer data confidence by solving for identity and providing a single view of the customer. With automated data ingestion and normalization, AI-powered customer journey reconstruction and personalized campaigns, Amperity is a good fit for financial services. It offers industry-specific solutions and integrates with leading marketing, analytics and data management tools, so businesses can get the most out of campaign ROI and customer engagement.

Insider

If you're looking for a system for personalizing customer experiences and predicting behavior, check out Insider. The system aggregates customer data and uses AI to provide 360° customer profiles and predictive behavior analysis. Insider spans a wide range of touchpoints and industries, with journey orchestration and audience segmentation. It's shown significant ROI and average order value increases and has won industry awards for its AI-powered personalization and omnichannel marketing.