Cardlytics empowers marketers to adapt to the changing landscape by delivering purchase intelligence to inform opportunities, target real people with relevant advertising and measure results with precision. The platform combines partnerships with leading banks to offer a comprehensive view of consumer spending, including purchases at competitors' businesses. This data can be used to target advertising and measure campaign effectiveness with precision.

With Cardlytics, businesses can:

- Capture market share: Attract new customers and shift competitor spend to your brand.

- Boost loyalty: Encourage repeat business from existing customers.

- Boost omni-channel sales: Reach customers across multiple touchpoints and platforms.

The platform is designed to provide insights into where, when and how people buy, based on data from more than 168 million bank customers. Advertisers can then target these customers with highly targeted ads within their banks' digital channels. This ensures that ads are delivered to verified adults who are actively managing their finances, delivering real value to customers.

Some of the key benefits of Cardlytics include:

- Native ads: Engage customers with a proprietary native ad platform that is seamlessly integrated into banks' online, mobile and email channels.

- Purchase Intelligence: Analyze transaction data to gain insights such as where and when customers buy, what channel they use, and how much they spend.

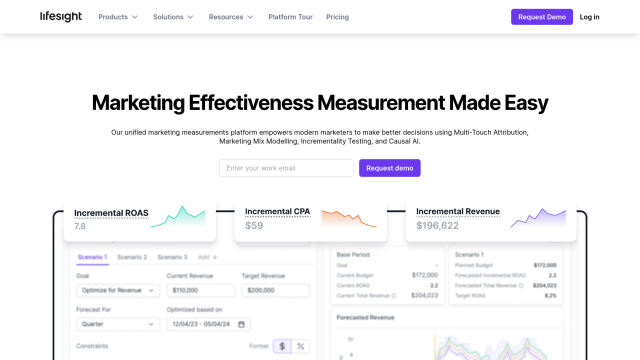

- Measurable sales impact: Measure the actual sales generated by campaigns, both online and in-store, to measure the incremental return.

Cardlytics has a broad range of experience across many industries including retail, grocery, e-commerce, telecom, restaurants, travel and luxury brands. Clients such as Dunkin', Clarks, Saatva, Marriott Hotels and Sky TV have seen significant improvements in customer acquisition and retention.

Cardlytics also offers regular research and insights into consumer spending trends, helping businesses keep up to date with changes in consumer behavior. Recent reports have covered topics such as the pet specialty retail category, UK dining trends, and the effect of the cost-of-living crisis on travel spending.

To learn more about Cardlytics and its capabilities, visit their website.

Published on July 2, 2024

Related Questions

Tool Suggestions

Analyzing Cardlytics...