Question: I'm looking for a solution that aggregates and enriches customer data from various sources, including transactions and receipts, to create detailed profiles.

Sensibill

If you need a way to aggregate and enrich customer data from different sources, Sensibill is a good candidate. It collects data from transactions, receipts, invoices and user metadata. Sensibill then processes and categorizes that data, offering merchant, product and brand-level information. The company's technology is geared for financial institutions, with features like receipt OCR, expense tracking and personalized spend advice, but it can help financial institutions generate revenue and improve engagement.

Twilio Segment

Twilio Segment is another good choice for customer data aggregation and enrichment. The company's platform collects, cleans and activates customer data, automatically enriching profiles with each new interaction. It's got more than 450 prebuilt connectors and features like generative AI for audience targeting and predictive AI for customer behavior. Twilio Segment is flexible, with a broad range of integrations and flexible pricing options, including a free tier.

Treasure Data

Treasure Data is a more powerful AI-based CDP that builds a single customer profile out of historical behavior, real-time data and AI-generated predictions. The company's technology breaks down data silos and helps sales teams work more efficiently, with strong data governance and compliance tools. Treasure Data has helped several companies achieve major business results, so it's a good option for large-scale enterprises.

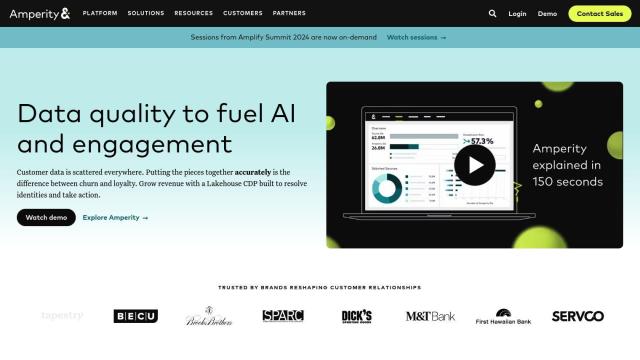

Amperity

If you want a more all-purpose and AI-based approach, check out Amperity. The company's technology helps companies build a single view of the customer, reconstruct customer journeys and figure out what drives revenue. It offers automated data ingestion and normalization, strategic insights and personalized campaigns based on first-party data. Amperity is designed to help you get the most possible return on investment from your campaigns and to better engage customers with predictive models and real-time feedback loops.