Question: Do you know of a tool that helps IR teams unify CRM data and track meetings and interactions with investors?

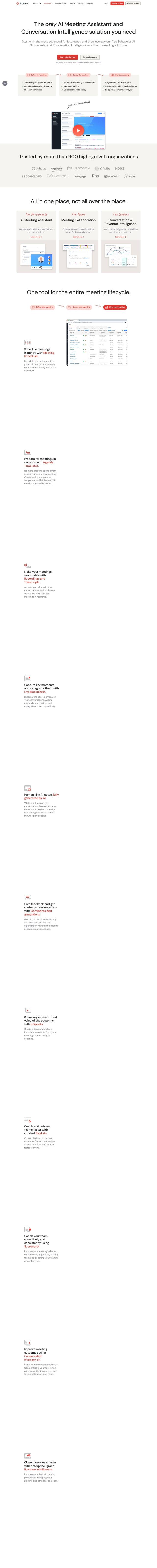

Q4

If you're looking for a tool to help IR teams unify CRM data and track interactions with investors, Q4 stands out as an excellent choice. This end-to-end IR operations platform combines critical IR tools with AI to automate workflows and deliver deeper insights. Key features include consolidating CRM data, managing relationships, and tracking engagement with a searchable capital markets contact database. It also provides real-time analytics, event coordination, and compliance features, making it a robust solution for IR professionals.

Affinity

Another noteworthy option is Affinity, a relationship intelligence platform that helps private capital investors and enterprise sellers maximize deal flow. Affinity features automated relationship intelligence, automated data entry, and deal flow management, which can help track and manage interactions with investors effectively. It’s designed to be user-friendly and is compliant with security standards like SOC 2 and GDPR, making it a secure choice for managing sensitive investor data.

VentureInsights.ai

For a more AI-powered approach, VentureInsights.ai offers a comprehensive platform for investment and fundraising. It includes tools for fundraising CRM, investor matching, and AI-powered deal management, making it easier to track and analyze interactions with investors. The platform is particularly valuable for startups and investors looking to streamline deal pipeline management and generate smart investor reports.

People.ai

Lastly, People.ai provides a data platform that automates the capture of prospect and customer activities and matches them to CRM contacts and opportunities. This can help IR teams make data-driven decisions and close deals faster. The platform integrates with popular tools like Salesforce and Slack, and offers features like SalesAI for automating manual work and assessing account health, which can be highly beneficial for tracking and analyzing investor interactions.

![Collective\[i\] full screenshot](https://screenshots.vectorlens.com/collectivei/collectivei-screenshot@640.jpeg)

![Collective\[i\] screenshot thumbnail](https://screenshots.vectorlens.com/collectivei/collectivei-thumbnail@640.jpeg)