Question: Is there a payment processing system that can securely collect payments and integrate with my existing tools?

Basis Theory

If you need a secure payment processing system that can be integrated with your existing infrastructure, Basis Theory is a great option. It provides a programmable vault platform for secure commerce flow, compliance and payments data. It includes payment services for recurring payments and lending, 3D secure support, and compliance with HIPAA, PCI Level 1, SOC 2 Type II, and ISO 27001 for secure and efficient payment processing. It also comes with SDKs for iOS, Android, React, and Node.js for easy integration with your existing infrastructure.

Inai

Another good option is Inai, a full-stack payment platform that streamlines payment operations with a single API. It integrates with many payment service providers (PSPs) to receive payments, make payouts, optimize transactions and reconcile payments. Inai has strong security, scalability to process up to 300 transactions per second, and flexibility to integrate with more than 50 payment vendors and 300 local payment methods in 180+ countries. This makes it a good fit for e-commerce, subscription and platform businesses seeking to lower payment failure rates and increase revenue.

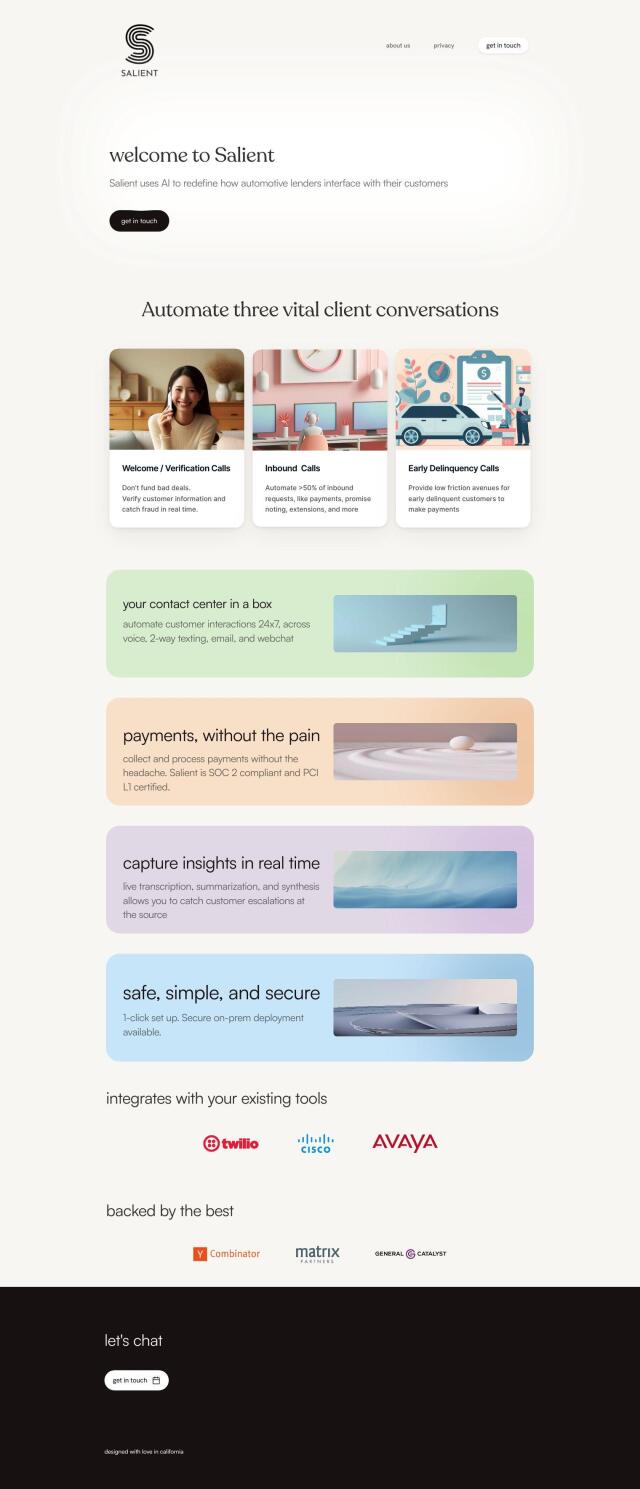

Salient

If you're looking for a more automated solution, Salient could be helpful. It's an AI-powered information retrieval system that can help you improve customer interactions, in particular for automotive lenders. Salient includes secure payment processing, contact center automation, and real-time transcription and summarization. It's certified for SOC 2 and PCI L1, and can be deployed on-premises for maximum control, making it a secure and efficient option for automating routine customer interactions.

Plaid

Finally, Plaid is a data network and payments platform that securely links users' financial data to your apps and services. It offers payment initiation, access to historical transaction data, real-time balance verification and easy setup for direct debits and payouts. With global coverage and a wide range of financial use cases, Plaid is a good option for businesses that want to integrate financial services securely and efficiently.