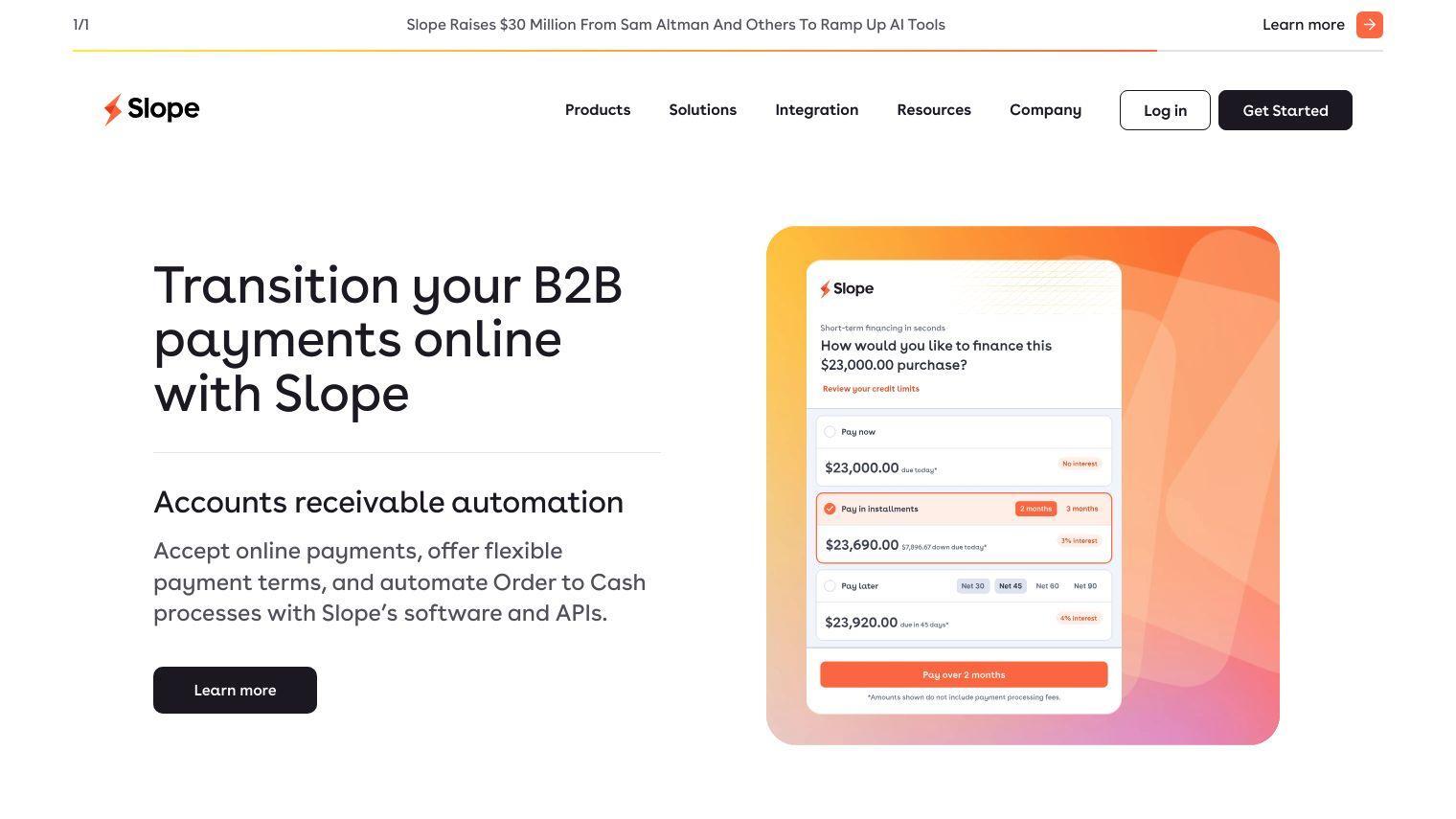

Slope streamlines B2B payments and order-to-cash processes with automated solutions that provide flexible payment terms and embedded financing. The platform uses APIs and a flexible architecture to help businesses automate their payment workflows, ensuring a seamless customer experience for accepting payments and managing financing.

Slope's features include:

- Seamless Payments: Accept credit card and ACH payments from businesses through a single API or no-code invoice links, with support for guest checkout, milestone-based invoicing, and same-day ACH.

- Embedded Financing: Offer net terms, installments, or custom payment plans to buyers with no additional risk, and get paid out immediately while Slope handles the risk and collections.

- AR Automation: Automate order-to-cash processes, eliminating manual tasks involved in processing customer orders and applying remittances to open orders in your ERP.

Slope supports a range of use cases, including B2B marketplaces, wholesalers, and AP automation platforms. It enables businesses to add online payments and invoicing in minutes, with flexible payment options and customizable credit risk management. Developers can quickly integrate Slope APIs, with low-code or no-code integration options available.

Slope's platform is designed to be secure, with enterprise-grade protection, service, and resiliency, and is compliant with SOC Type 1 and Type 2 standards. This means that customer data is protected in the cloud.

Pricing information is not disclosed as fees depend on loan amounts and business needs. Prospective customers should visit the Slope website for pricing details and to explore specific product offerings.

Published on June 14, 2024

Related Questions

Tool Suggestions

Analyzing Slope...