Question: Do you know of a platform that provides sector-wise newsletters, deal pipeline management, and CRM integrations for investment banks and companies?

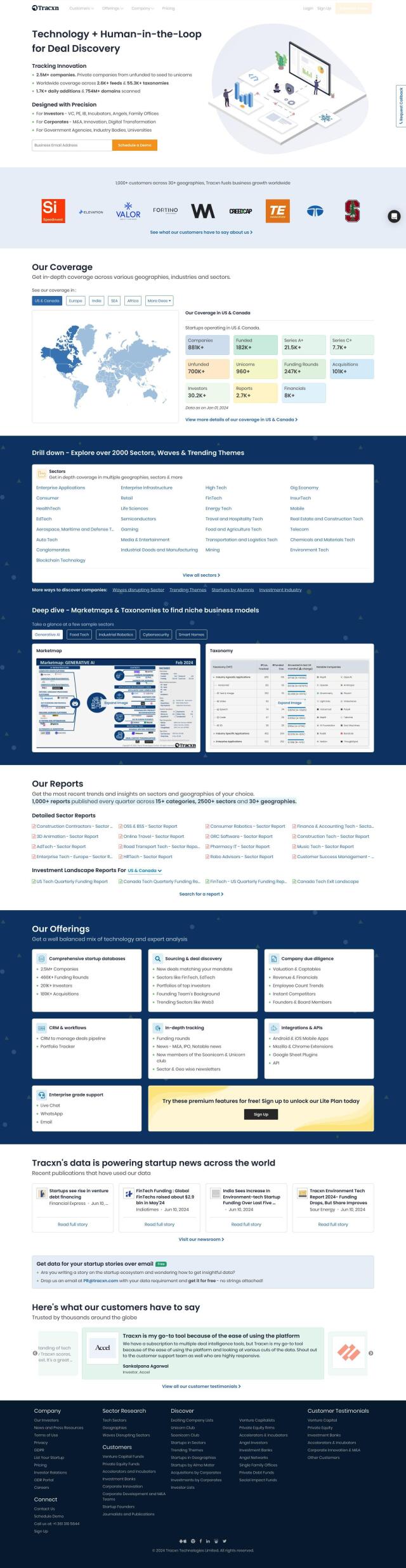

Tracxn

Tracxn is an information retrieval platform for venture capitalists, private equity firms, investment banks and companies. It offers detailed information for deal sourcing and business development, covering 2.5 million companies and 55,300 taxonomies. It includes detailed reports on over 1,000 sectors, quarterly funding reports, and access to company data such as valuation, revenue, and financials, along with CRM and workflow integrations.

VentureInsights.ai

Another good option is VentureInsights.ai, an AI-powered investment and fundraising platform. It connects startups and investors, offering deep insights to help manage deal pipelines and create investment reports. Features include fundraising CRM, smart investor reporting, benchmarking tools, and AI-powered deal management, making it a good option for managing and tracking deal pipelines.

CrustData

For a more complete solution, CrustData offers an AI-powered information retrieval system for investors and sales teams. It offers real-time data, dynamic CRM enrichment, investment intelligence, and competitive intel through a large proprietary database. It's good for finding exact-match similar companies and competitors, and can help you make better investment and sales decisions.

![Collective\[i\] full screenshot](https://screenshots.vectorlens.com/collectivei/collectivei-screenshot@640.jpeg)

![Collective\[i\] screenshot thumbnail](https://screenshots.vectorlens.com/collectivei/collectivei-thumbnail@640.jpeg)