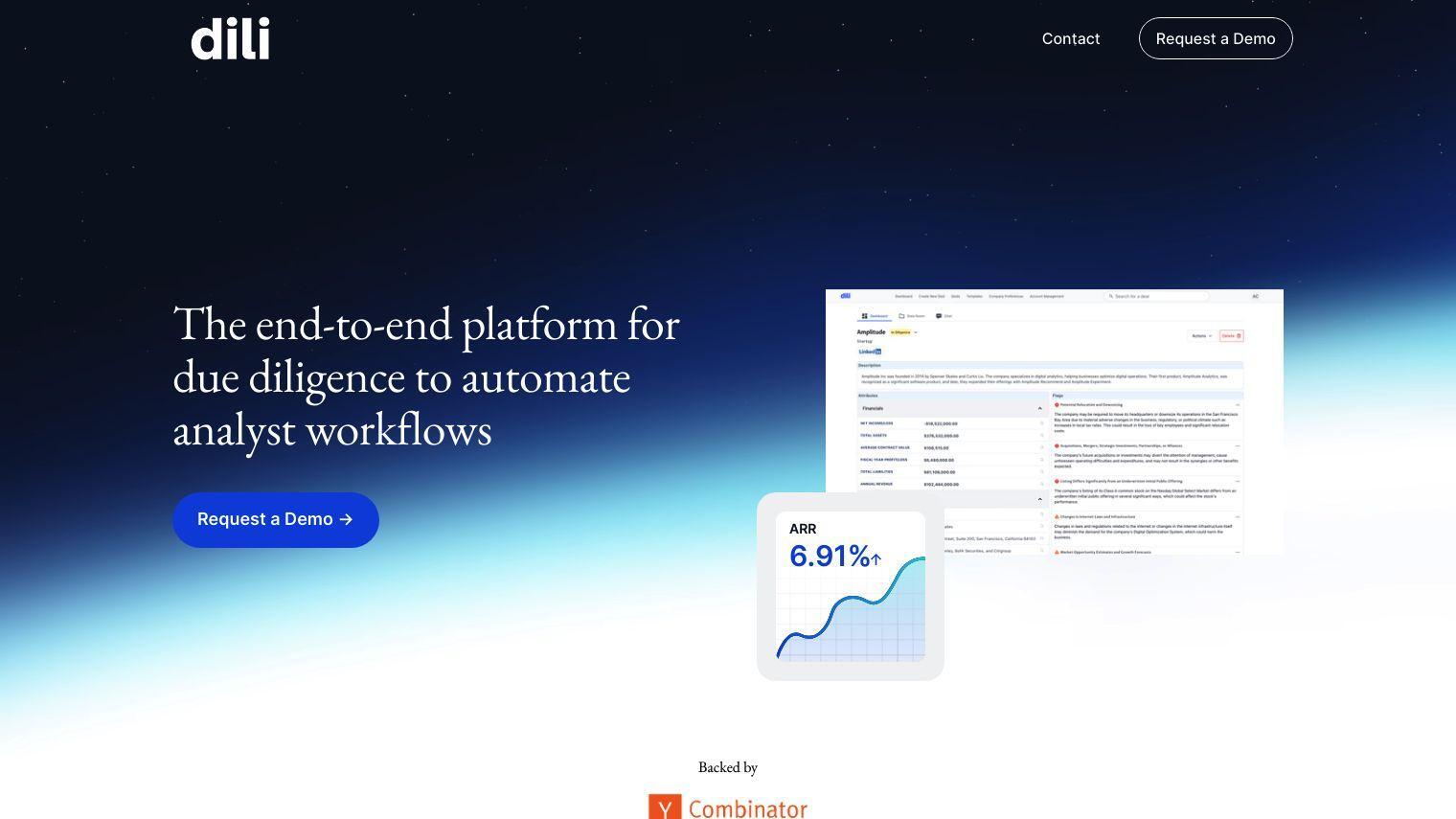

Dili is a deal platform built for venture funds and private equity, using AI to contextualize new deals and help make decisions. It's an end-to-end due diligence solution, automating analyst work and serving as a system of record for funds.

Dili offers several important features to help you manage deals efficiently:

- Unified Data: Pulls data from sources like Google Drive, Dropbox, Email, Pitchbook and CapIQ without requiring manual input.

- Automatic Comps: Automatically generates private deal comps and benchmarks from your own data for screening and qualification.

- Custom Reports: Uses machine learning models to create reports and documents in your preferred format, automatically.

Dili is geared for venture fund and private equity customers, but the company has other use cases in mind:

- Automated Comps Generation: Using the latest NLP and NER to structure data and generate comps and benchmarks.

- Data Room Issue Flagging: Flagging potential deal issues like high spend, low cash runway and legal issues.

Dili has processed more than 1300 deals so far and has more than 500 customers, with more than $50B+ AUM of funds using the service. It's also got a SOC2 Type II certification, which means data is encrypted at rest and in transit.

The company doesn't reveal pricing or setup details. You can request a demo to see how Dili can help you supercharge your diligence with AI.

Published on June 14, 2024

Related Questions

Tool Suggestions

Analyzing Dili...