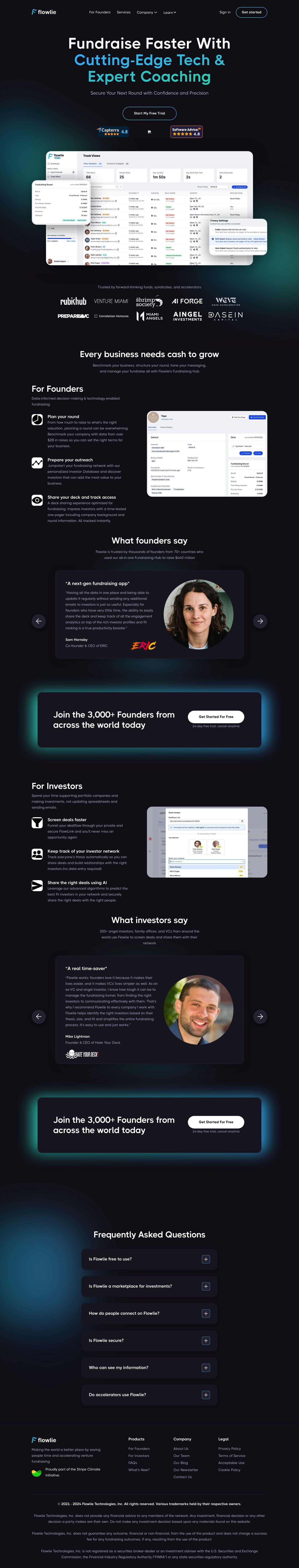

Flowlie is a data-rich platform that helps venture capital founders and investors manage fundraising and investor relationships. It's a collection of tools to help founders raise their next round of funding with confidence and precision. For investors, Flowlie helps them screen deals and manage their network.

For founders, Flowlie offers:

- Fundraising Hub: Plan your round, organize your outreach and track your fundraising.

- Benchmarking: See how your business compares to over $2 billion in raises to determine the best terms.

- Personalized Investor Database: Find and connect with investors that are the best fit for your business.

- Deck Sharing: Send a one-pager with company background and round details, with real-time tracking of investor engagement.

For investors, Flowlie offers:

- Screen Deals Faster: Send deal flow through a private and secure link.

- Track Investor Network: Automatically update investor thesis and send deals to the right people.

- AI-Powered Deal Sharing: Use advanced algorithms to predict the best fit investors and send deals securely.

Flowlie helps founders save time and streamline fundraising with data-informed decision-making and technology-enabled tools. Thousands of founders from more than 70 countries have used the platform to raise more than $440 million, and investors, including angel investors and venture capital firms, use Flowlie to manage deal flow and network.

Pricing includes a free version with limited functionality, with the option to upgrade to Flowlie Pro for full access to features. A 14-day free trial is available, so users can try the platform before committing to a subscription.

By automating and optimizing fundraising and investor management, Flowlie hopes to help founders and investors close deals faster and more effectively, speeding up the growth of venture capital.

Published on June 14, 2024

Related Questions

Tool Suggestions

Analyzing Flowlie...