Question: Is there a tool that provides benchmarking data for venture capital raises to determine the best terms?

Flowlie

One of the highest-profile options is Flowlie, a data-rich service designed to make fundraising and investor tracking easier. It's got a Benchmarking tool that lets founders raise money with more confidence and precision. The service has a lot of other tools, too, including a Fundraising Hub and a Personalized Investor Database, so it's a good option for venture capital founders.

VentureInsights.ai

Another contender is VentureInsights.ai, an AI-powered service for investments and fundraising. It offers detailed analysis and benchmarking tools for a portfolio, useful for startups trying to track their deal pipeline and for investors trying to generate reports for investors. Its Yardstick benchmarking tool is useful for comparing investments and making decisions.

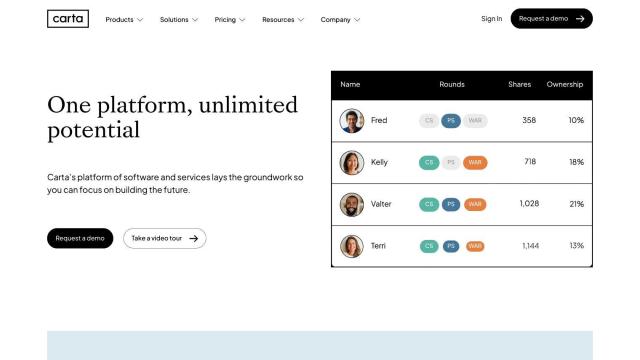

Carta

And Carta offers a variety of tools for equity management and fundraising. Its primary business is equity management and company investment, but it's got detailed benchmarking and reporting tools, too. That makes it a good option for venture capital firms that want to track their investments and understand what's going on in the market.