Question: Do you know of a platform that provides credibility scoring for mobile subscribers based on behavior patterns and billing data?

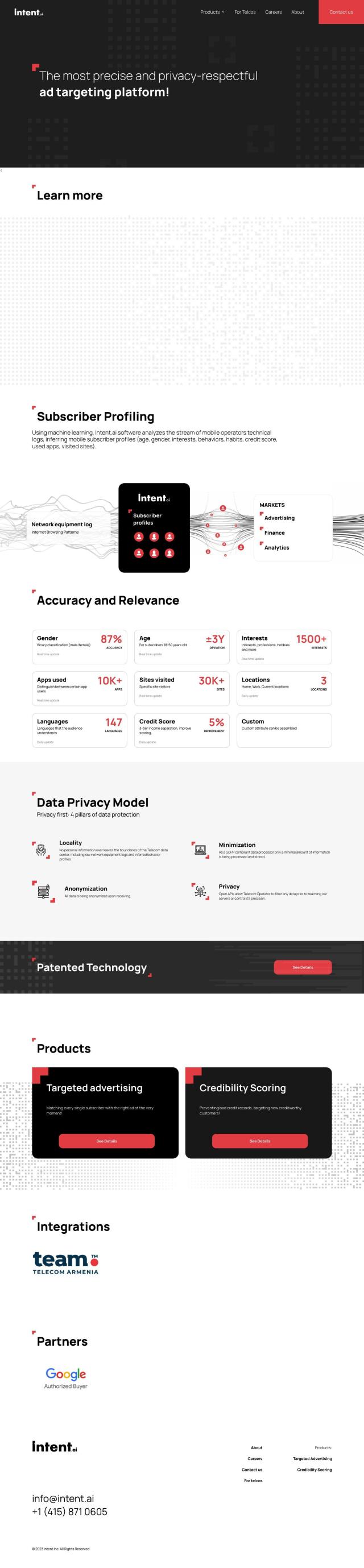

Intent.ai

If you're looking for a platform that offers credibility scoring for mobile subscribers based on behavior patterns and billing data, Intent.ai is a good option. The platform offers targeted advertising and credibility scoring through machine learning processing of technical logs and creation of rich subscriber profiles. It can track demographic information, interests, behavior and habits, and use digital behavior patterns and billing data to prevent bad credit records and identify creditworthy customers. This means that telecom operators can open up a new revenue stream without losing control over their data.

JuicyScore

Another option is JuicyScore, which offers device risk assessments and online-user protection by analyzing non-personal and behavioral data. It assesses more than 50,000 parameters for each device, including user behavior and internet connection data, to identify high-risk clients and flag suspicious activity. It can be used in industries such as financial services, e-commerce, insurance and travel to ensure safe business operations and compliance with global security standards.

LexisNexis Risk Solutions

For a more comprehensive risk management system, LexisNexis Risk Solutions offers a variety of services including credit risk assessment and fraud management. It combines a large database of public and proprietary information with advanced analytics to provide actionable insights, helping organizations identify and mitigate risks. The platform is designed to improve efficiency and decision-making across a range of industries, including financial services and insurance.

Kount

Last, Kount is a digital trust and safety solution that uses real-time AI and machine learning for fraud prevention and identity verification. It creates detailed customer profiles based on hundreds of data points, helping businesses understand their customers better and interact with them securely. Kount offers real-time authentication and streamlines compliance with industry regulations, making it a good option for e-commerce and other industries.