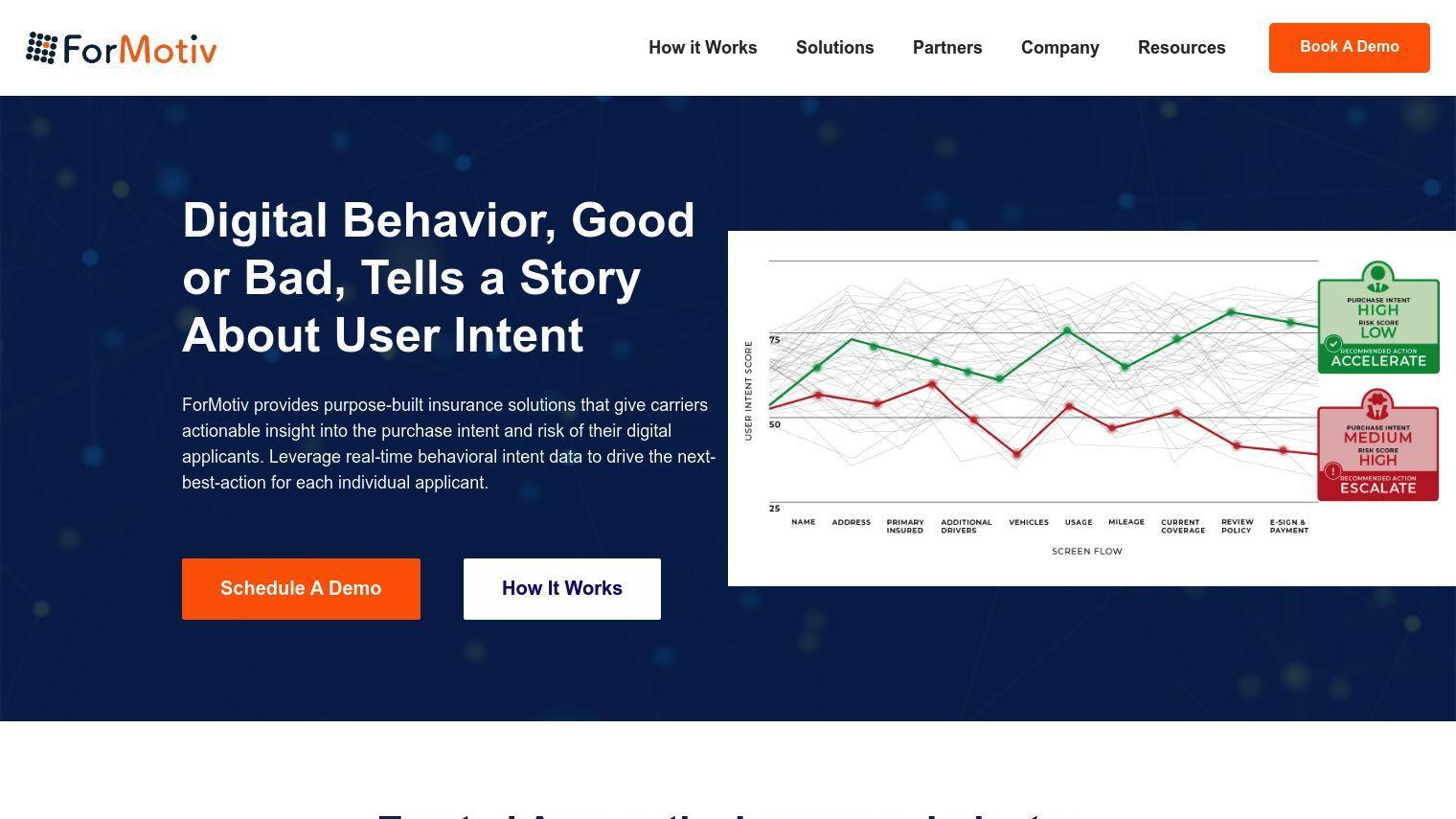

ForMotiv offers behavioral analytics tailored for the insurance industry, allowing carriers to infer intent and minimize premium leakage. By capturing hundreds of unique behavioral data signals and converting them into easy-to-understand intent scores, ForMotiv gives carriers a better understanding of applicants' purchase intent and risk profile.

The platform uses this information to determine the next-best-action for each applicant, whether that's focusing on high-intent buyers or adding friction for high-risk applicants. ForMotiv's machine learning technology analyzes tens of thousands of digital behavioral data points in real-time to make accurate predictions about user intent.

ForMotiv offers customized solutions for a range of insurance markets, including life, home, auto and commercial insurance. It can be used for:

- Purchase Intent Prediction: Identify high-intent buyers and window shoppers to optimize marketing and outbound efforts.

- Premium Leakage Prevention: Dynamically triage applications that show signs of premium leakage and misrepresentation.

- Agent Oversight: Offer detailed behavioral insights and analytics for agent distribution channels.

- Conversion Rate Optimization: Segment and focus on high-intent applicants to maximize conversions.

Some of the key aspects of ForMotiv include:

- Real-Time Behavioral Intent Data: Captures and processes unique behavioral micro-expressions.

- Intuitive Data Features: Provides features like hesitation, error rate collections, and cognitive loads.

- Easy Integration: JavaScript integration through Tag Manager.

- Glass-Box Approach: Gives access to 5,000+ behavioral data points in real-time or batch files.

- 1st Party Behavioral Data: Curated data that can be easily combined with existing data.

- Totally Safe & Secure: No PII captured, GDPR & CCPA compliant.

The more customers ForMotiv has and the more data it collects, the more valuable the platform becomes. With more than 1 million insurance applications analyzed, 1 trillion unique behavioral micro-expressions captured and 1,000 curated features developed, the company is able to continually improve its predictive models and return on investment for customers.

ForMotiv doesn't share pricing details, but you can schedule a demo to see the platform's features and ROI examples in more detail. With its technology, ForMotiv hopes to help insurance carriers make better underwriting decisions, lower risk and improve customer satisfaction.

Published on June 29, 2024

Related Questions

Tool Suggestions

Analyzing ForMotiv...