Question: Can you recommend a service that integrates with Stripe to monitor and respond to suspicious payment activity?

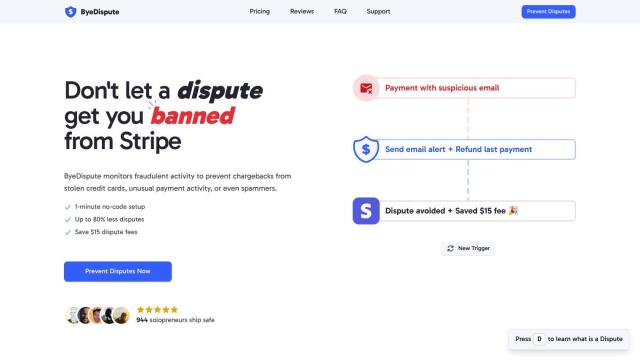

ByeDispute

If you're looking for a service that integrates with Stripe to monitor and respond to suspicious payment activity, ByeDispute could be just what you're looking for. This fraud detection and prevention system monitors Stripe accounts for patterns that could indicate fraud and automatically takes action to prevent disputes and associated fees. It includes features like automated fraud detection, proactive dispute prevention, and dashboard alerts. Setup is easy and requires no programming, so it's good for solopreneurs and startups.

Flagright

Another option to consider is Flagright. This AI-native AML compliance and fraud prevention platform is geared for fintechs and financial services companies. It includes automated case management, AI-based risk scoring, real-time transaction monitoring, and a collaborative console. Flagright's advanced AI algorithms can detect potential risks and improve fraud prevention, allowing for efficient and accurate transaction monitoring.

Verisoul

Verisoul is another fraud detection and prevention platform that integrates well with Stripe. It automates manual processes and consolidates vendors to stay ahead of fraudulent activities. Verisoul uses a variety of signals to ensure users are real and unique, including device risk, proxy detection, and geolocation analysis. It includes automated decisions and workflows, so it's easy to integrate and manage fraud prevention across multiple industries.