Question: Do you know of a tool that provides unparalleled insights into market trends and investor behavior, with access to a universe of over 3.3 trillion euros in data analytics?

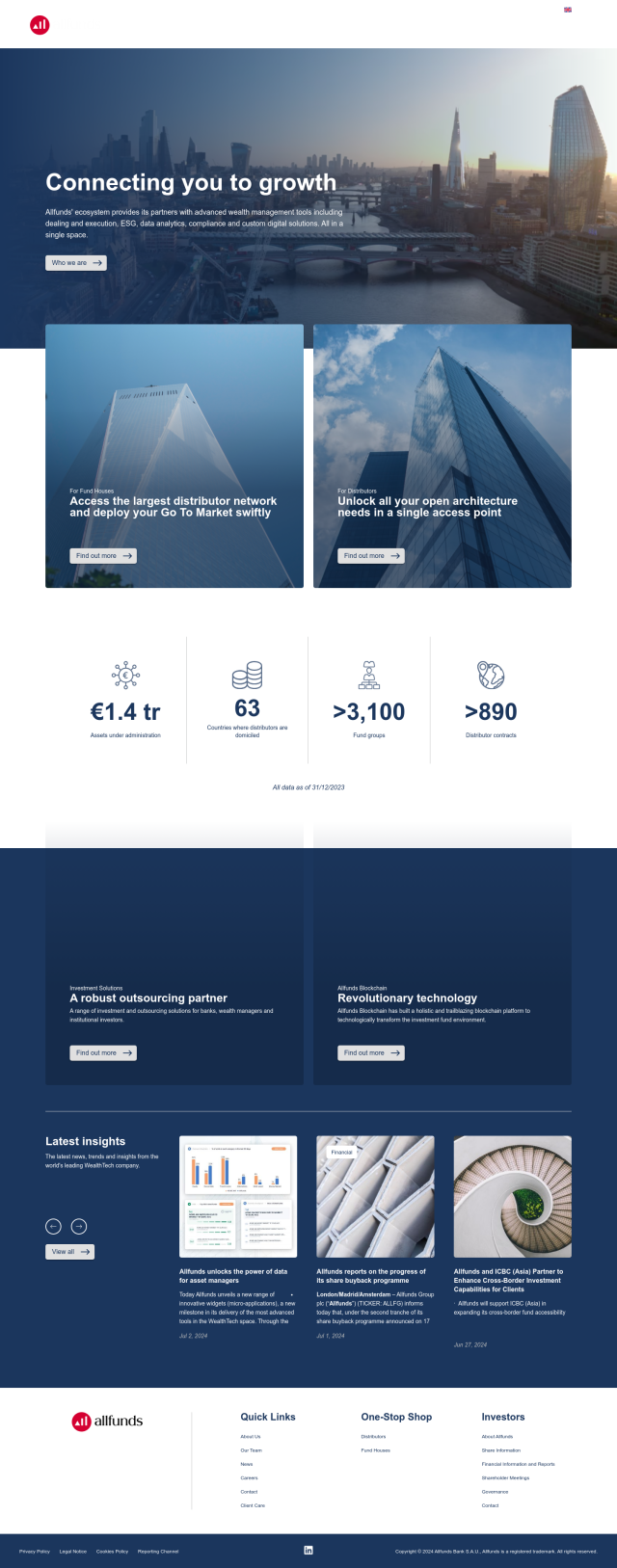

Allfunds

For the most detailed views of market trends and investor behavior, Allfunds offers a full WealthTech platform. With access to more than 3.3 trillion euros of data analytics, Allfunds offers wealth management tools including dealing and execution, ESG and custom digital solutions. The platform aggregates browsing data from more than 800 financial institutions and uses AI algorithms to provide detailed analysis of market trends and investor behavior, making it a powerful option for banks, wealth managers and institutional investors.

AlphaSense

Another top contender is AlphaSense, a market intelligence and search platform powered by AI and NLP to quickly find information in a massive library of more than 300 million documents. The service can save you hours of manual research time and keep you up to speed with real-time monitoring and tracking so you're never caught off guard. It's geared for financial services companies, corporate strategy teams and consulting firms, offering tools for market intelligence, enterprise intelligence and Wall Street insights.

LSEG Data & Analytics

LSEG Data & Analytics is another option. The platform offers global market data, analytics and workflow solutions to more than 40,000 customers and 400,000 end-users. It offers AI-powered analytics, real-time user-defined parameters and broad cross-asset data, making it a one-stop-shop for wealth advisors, investment bankers and portfolio managers. The platform supports sustainable growth and offers detailed technical documentation and support resources.

Market Logic

For those who want AI-powered insights solutions, Market Logic's DeepSights offers real-time access to market and consumer insights. The platform aggregates insights data and knowledge through a single AI-powered gateway, offering natural language AI interactions and maximizing the productivity of insight teams. It can be integrated with business processes and systems, making it a good option for institutional investors and asset managers.