Question: Is there a tool that can help me simplify and automate cross-border eCommerce shipments, including duties and taxes calculation?

Glopal

If you're looking for a service to streamline and automate cross-border eCommerce shipments, including calculating duties and taxes, Glopal is a good choice. It has a range of tools geared for international e-commerce, including duties, taxes, shipping and returns. Glopal's Convert (powerful localization and global payment tools) and Delight (omnichannel experiences) tools let you turn your store into more than 100 fully localized versions instantly, so it's a good choice for large businesses trying to go global.

CrimsonLogic

Another service worth a look is CrimsonLogic, which offers a broad suite of tools for global trade designed to simplify logistics and trade compliance. Its Cross Border eCommerce module is geared for digitalizing eCommerce shipments, including duties and taxes calculation. The company's other tools include Regulatory Filing for customs declarations, Logistics for ocean freight management, and Single Window for exchanging information between traders and government agencies, so you can expect a smooth and secure global trade operation.

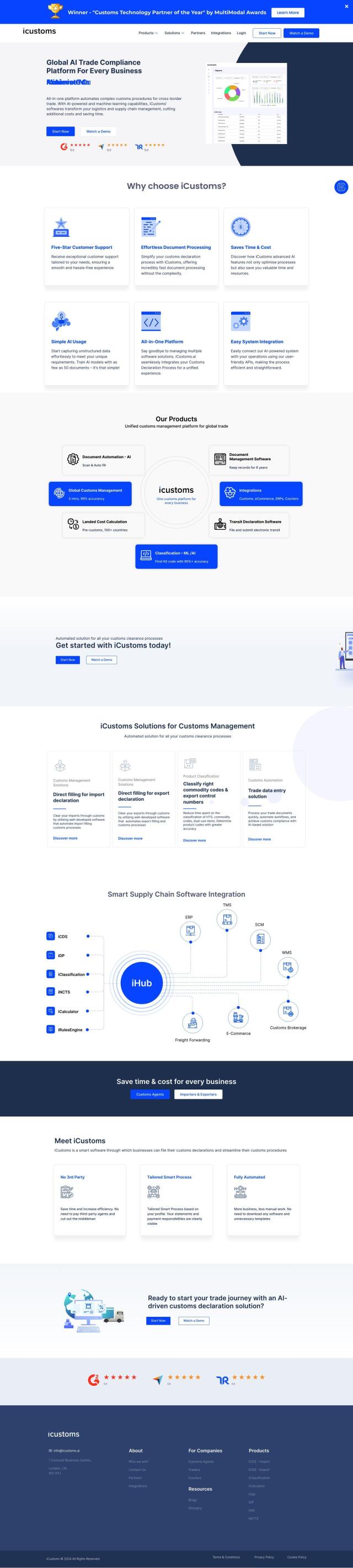

iCustoms

For a focus on customs declaration and global trade management, iCustoms is a good option. It uses AI and machine learning to automate customs filing and document management, and it offers global customs management with high accuracy. The platform calculates landed costs for over 100 countries pre-customs clearance and integrates with eCommerce, ERPs, and courier services, so it's a good option for importers, exporters, and customs agents trying to cut manual work and delays.

NimbusPost

Last, NimbusPost is an e-commerce logistics and shipping service that offers global shipping and warehouse fulfillment. With AI and ML technology, NimbusPost simplifies cross-border trading and offers door-to-door air cargo delivery, real-time management of NDRs, and inventory storage around the world. This can help businesses shorten delivery times and cut RTOs, which can improve the customer experience and increase revenue.