MX

If you're looking for another InvestCloud alternative, MX could be worth a look. MX offers a platform that lets financial institutions and fintechs connect financial accounts, gain insights and create personalized money management experiences. It securely aggregates and verifies financial data, adds context and helps businesses create personalized financial experiences that can help drive engagement and growth. With connections to more than 13,000 financial institutions and more than 170 billion transactions per day, MX offers security and compliance through permission-based and secure data sharing.

Hearsay Systems

Another option is Hearsay Systems, a digital engagement platform for distributed financial services teams. It helps build deeper client relationships through compliant social media, texting and local websites, and is geared for lead acquisition, sales engagement optimization and client service. With deep integration with CRM, sales and marketing systems, Hearsay Systems is used by more than 140 major financial firms and serves more than 260,000 financial representatives. It's designed to reduce complexity and risk while improving the client experience.

Engine

If you want a broader financial marketplace, check out Engine. This platform connects consumers with a broad range of financial products and services from more than 1,000 financial partners. Engine has precision matching and personalization technology to help businesses acquire, grow and monetize their customer base. It covers a range of financial services including loans, credit cards and financial wellness management tools, and offers flexible integration options to optimize and scale programs.

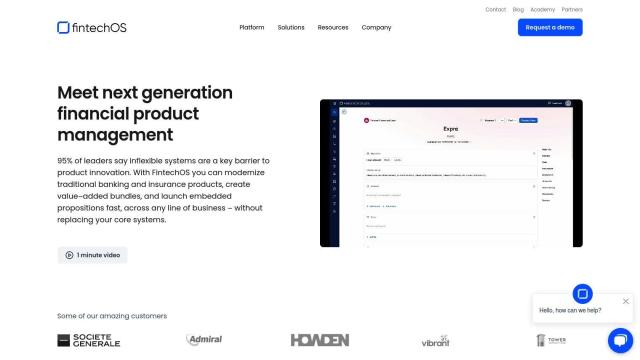

FintechOS

Last, FintechOS offers a platform that extends core banking and insurance systems. It lets financial services companies innovate and launch new products, digital journeys and back-office workflows without having to replace existing systems. With a low-code/no-code studio for creating data-driven financial products and customer journeys, FintechOS is designed to speed up the time-to-market for new financial products and lower complexity and cost. It can be used for personal finance, commercial banking, embedded finance and property and casualty insurance.