Question: Is there a mobile SDK that can help me reduce payment fraud and increase conversion rates in my app?

Jumio

Jumio has an AI-based identity verification platform that blocks fraud, helps you comply with regulations and get customers up and running faster. With features like ID document checks, selfie comparisons and liveness detection, it offers a risk score that can be tailored to your business needs. It can handle more than 5,000 types of IDs and integrates with more than 300 data vendors, so it can work in a variety of businesses.

Forter

Forter is another powerful Identity Intelligence platform that makes real-time decisions for every customer interaction. It includes tools like Fraud Management, Payment Optimization and Chargeback Recovery that can help you cut payment fraud and boost authorization rates. Forter has cut chargeback rates by an average of 72% and false declines by an average of 46%, according to the company, so it's a good option if you're trying to run your digital commerce business as smoothly as possible.

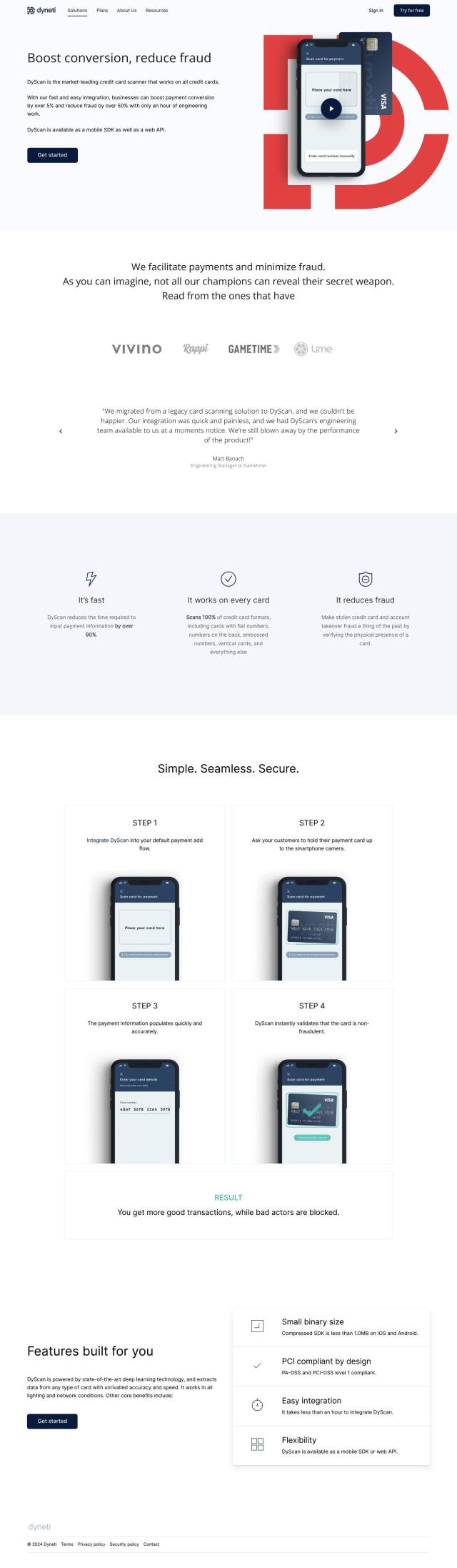

DyScan

DyScan is a credit card scanning SDK that uses deep learning technology to read card data accurately and speed up payments. It's PCI compliant and can be integrated quickly, offering high accuracy and fraud reduction through the verification of physical card presence. This tool is designed to improve the payment experience while maintaining high security, making it a good option for businesses of all sizes.

Prove

If you're looking for a more extensive digital identity verification and authentication platform, Prove is worth a look. It offers a range of tools including Prove Pre-Fill, Prove Identity, Prove Auth and Prove Identity Manager that can speed up identity verification and cut fraud. Prove is used by more than 1,000 companies around the world and has bank-grade security with encryption and machine learning.