Question: Can you recommend a tool that helps me streamline my equity management and cap table organization?

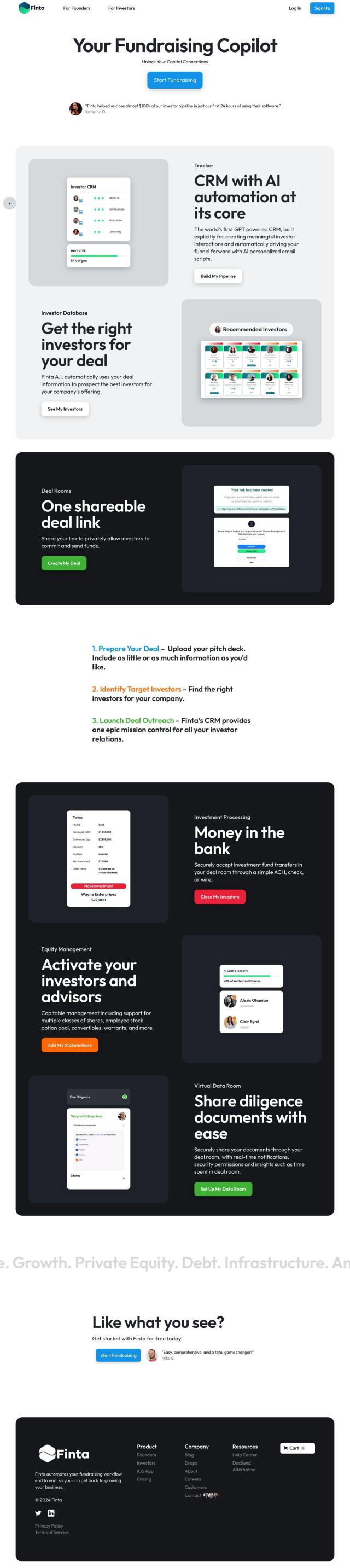

Finta

If you're looking for a tool to streamline equity management and cap table organization, Finta is an excellent choice. It offers a comprehensive suite of features, including equity management and cap table management, along with secure deal rooms and AI-powered investor matching. Finta's CRM with AI automation can personalize email scripts and advance the investment funnel, making it easier to manage deal flow and connect with investors. The platform also includes flexible pricing options, including a free Basic plan.

FinanceGPT

Another strong option is FinanceGPT, which uses generative AI to provide detailed financial insights. While it doesn't specifically focus on equity management, it offers tools for financial health monitoring and forecasting, which can be useful in making informed decisions about your equity. It supports a wide range of financial transactions and provides actionable insights through advanced analytics, making it a valuable resource for financial managers and investors.

Dili

For a more specialized approach, Dili is an AI-powered deal platform designed for venture funds and private equity. It integrates data from various sources and automates due diligence and analyst workflows, generating private deal comps and benchmarks. Dili also offers custom reports and data room issue flagging, making it easier to manage and analyze complex financial data.

Facta

Lastly, Facta is a financial data management software that consolidates and automates financial data from multiple sources into a single dataset. It's designed for finance professionals, including those in private equity and venture capital, offering real-time data access and sophisticated metrics creation. This tool can help standardize metrics, model data faster, and centralize financial data effectively, improving accuracy and consistency in financial analysis.