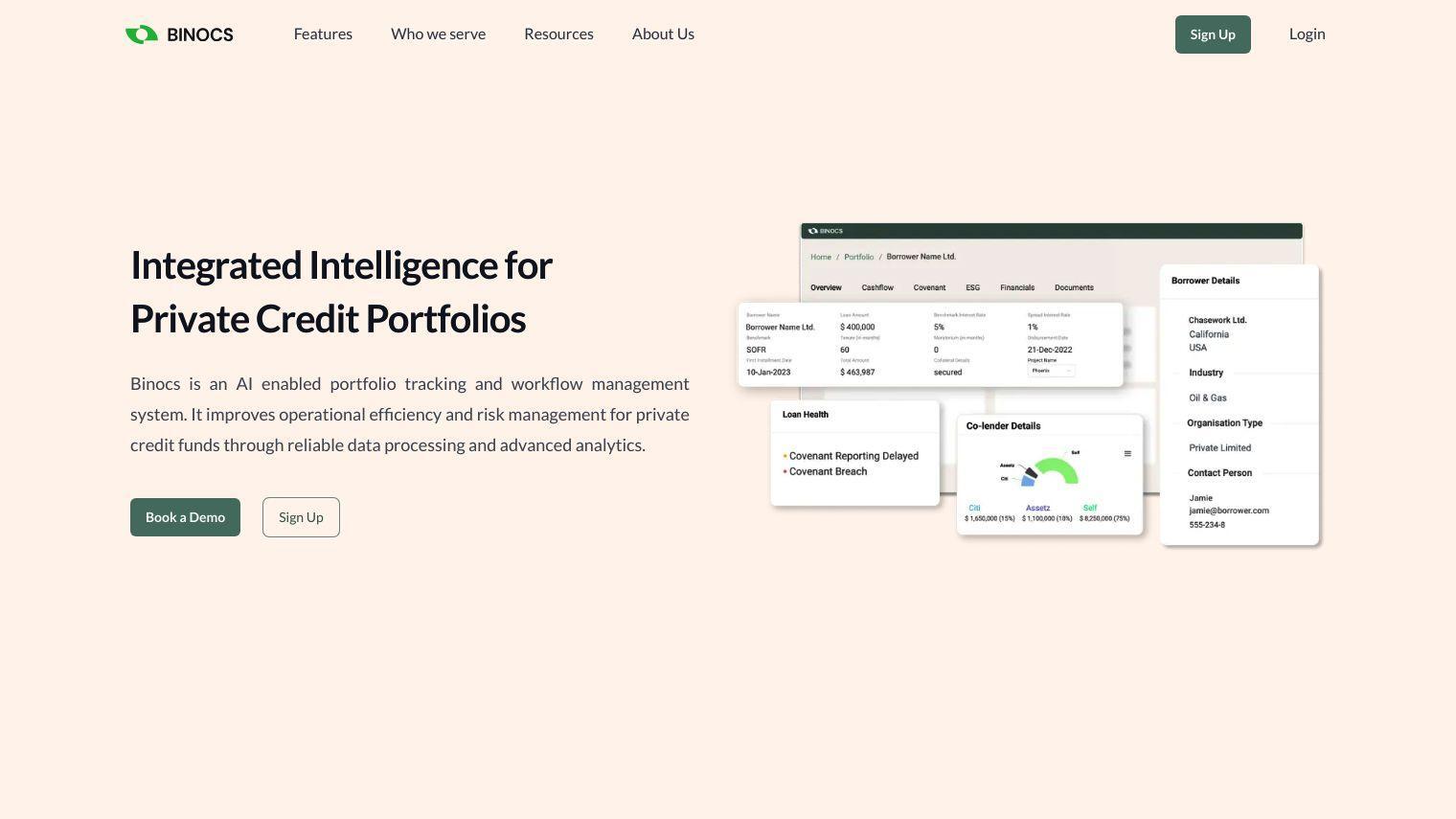

Binocs provides an AI-powered loan management system that is designed to increase operational efficiency and risk management for private credit funds. It uses Artificial Intelligence (AI) to extract financial information from various documents and present it in a normalized format for better analysis.

Some of the key features include:

- High Integrity Financial Data Extraction: Pulls data from Financial Statements, Balance Sheets, Income Statements and other documents, digitizes credit agreements and provides a calendar view of events.

- Streamlined Cashflow, Covenant & ESG Monitoring: Tracks repayments, covenants and ESG, and sends notifications and automated reminders to counterparties.

- Risk Management and Early Warning System: Assigns risk scores to loans based on borrowers’ financial health, credit history, and internal and external factors, and provides early warnings on portfolio health.

- Automated Document Management: Centralizes documents in one place, allowing for timely collection, digitization and a searchable repository with metadata.

- Automated Notifications and Reminders: Sends notifications to borrowers for repayment and reporting, and keeps a record of communication trails.

- Integrations with Market Intelligence Platforms and Data Rooms: Pulls documents from various sources.

- Bespoke Financial Modeling: Customizes financial models to meet specific needs.

- Coordinate with Co-Lenders: Enables co-lenders to communicate and manage documents in one place.

Binocs is designed for asset managers, borrowers and service providers such as lawyers, auditors and administrative agents. It enables asset managers to efficiently manage portfolio borrowers, track loan books and proactively track covenants and ESG. Borrowers can manage all lenders in one place, avoiding covenant default and penalties. Service providers can easily access and review covenant reports and financial documents.

By combining powerful covenant tracking, cash flow management, document management and central communication, Binocs aims to improve operational efficiency and reduce risk for institutional lending stakeholders. If you're looking for a tool to simplify your loan management processes and take advantage of AI to better manage risk, Binocs is a good candidate. You can schedule a demo on their website to see the platform and its features in action.

Published on June 14, 2024

Related Questions

Tool Suggestions

Analyzing Binocs...