Question: Is there a credit-building service that uses alternative data sources to assess creditworthiness?

Nova Credit

If you're interested in a credit-building service that taps into alternative data sources, Nova Credit is a good choice. It collects consumer credit data from sources like international credit bureaus, bank data aggregators, payroll systems and automated document data. Nova Credit provides services like Cash Atlas for credit risk assessment, Income Navigator for income verification, and Credit Passport for quick approval of newcomers to mainstream credit. The company's platform lets lenders extend credit to people who are underserved and reduce risk by using alternative credit data.

TomoCredit

Another good option is TomoCredit, which uses alternative data and its own proprietary algorithm to evaluate creditworthiness. It's geared for people without traditional credit history and also offers credit building, credit monitoring and financial advice through an AI chatbot. TomoCredit offers a charge card with a 7-day automatic payment option and spending limits between $100 and $30,000. The service promises fast and easy approval that doesn't hurt your credit score.

Envestnet | Yodlee

If you're looking for a broader financial data aggregation service, Envestnet | Yodlee has access to more than 17,000 global data sources, including alternative credit data. It can provide a detailed view of customers' financial lives through AI-powered financial experiences, transaction data enrichment and financial data APIs. It's good for fintech companies and financial institutions trying to drive growth while staying compliant and happy customers.

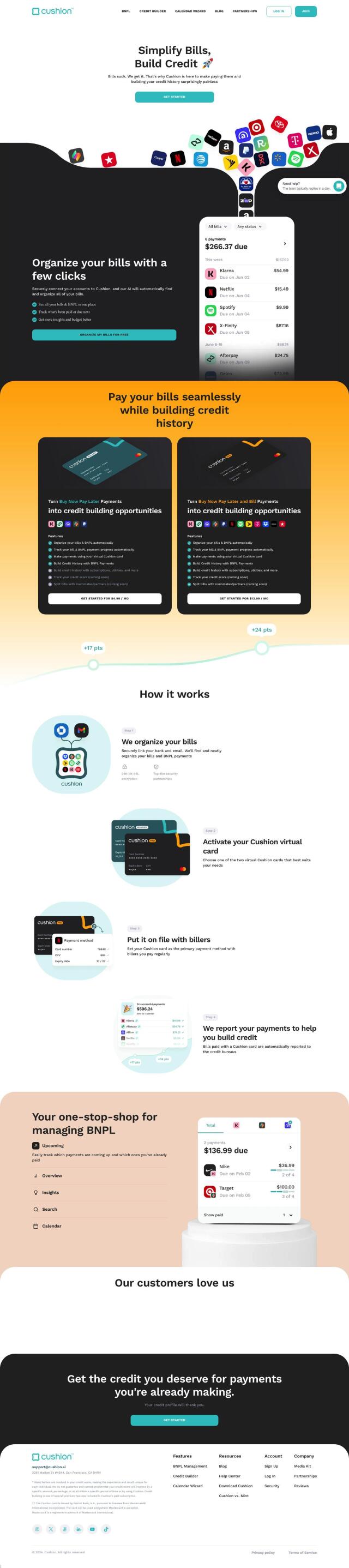

Cushion

If you're looking for a tool to manage bills and build credit, Cushion offers a unified view of your financial obligations. It includes tools like bill organization, credit score tracking, payment management through a virtual Cushion card and BNPL management. Cushion helps you keep track of your financial responsibilities and build your credit history.