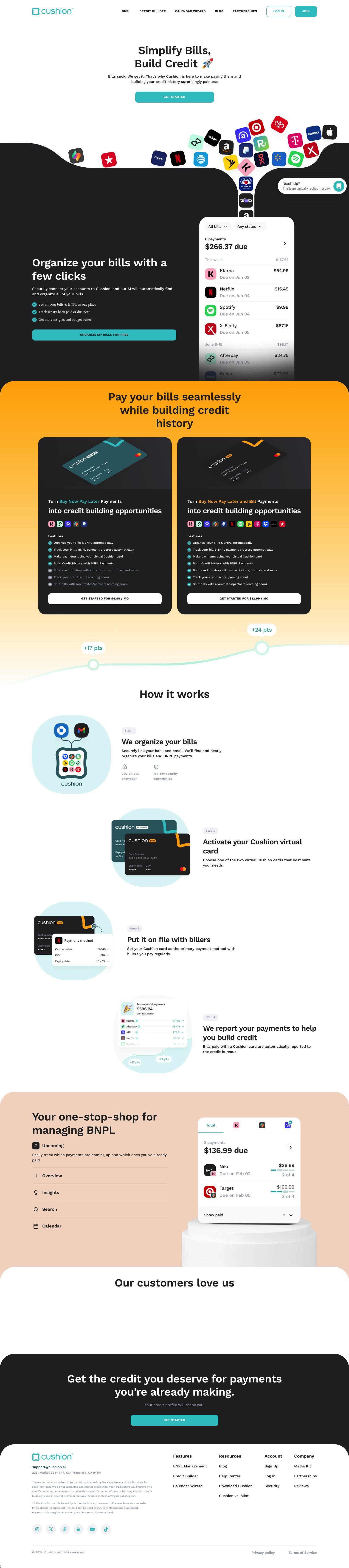

Cushion is a financial management app that helps you organize bills and build credit history. By securely linking your accounts, Cushion automatically detects and organizes all of your bills and Buy Now Pay Later (BNPL) payments, giving you a single view of your financial commitments.

Some of the features of Cushion include:

- Bill Organization: See all of your bills and BNPL payments in one place, track what you've paid or what's due next, and get more visibility to make more informed budgeting decisions.

- Payment Management: Make payments with a virtual Cushion card, which helps you build credit with subscriptions, utilities, and other bill payments.

- Credit Score Tracking: Monitor your credit score (launching soon) and get a better understanding of your financial health.

- Split Bills: Split bills with roommates or partners (launching soon).

- Calendar Sync: Sync your bills with your Google Calendar so you'll never miss a payment due date again.

- BNPL Management: Track and manage all of your Buy Now Pay Later payments in one app, turning them into credit-building opportunities.

Cushion offers two pricing tiers:

- $4.99/month: Turn Buy Now Pay Later payments into credit-building opportunities.

- $12.99/month: Turn both Buy Now Pay Later and bill payments into credit-building opportunities.

Cushion's goal is to make paying bills and building credit surprisingly easy. By automatically tracking your bills and reporting your payments, Cushion offers a simple way to manage your financial responsibilities and improve your credit score over time.

Published on June 14, 2024

Related Questions

Is there an app that can help me organize and track all my bills and payments in one place? I'm looking for a way to build my credit score without taking out a loan or credit card - are there any alternative options? Can you recommend a tool that allows me to manage and pay my bills on time, and also helps me improve my credit history? I'm tired of keeping track of multiple due dates - is there a service that can sync my bills with my calendar and send me reminders?

Tool Suggestions

Analyzing Cushion...