Question: Can you recommend a tool that allows me to manage and pay my bills on time, and also helps me improve my credit history?

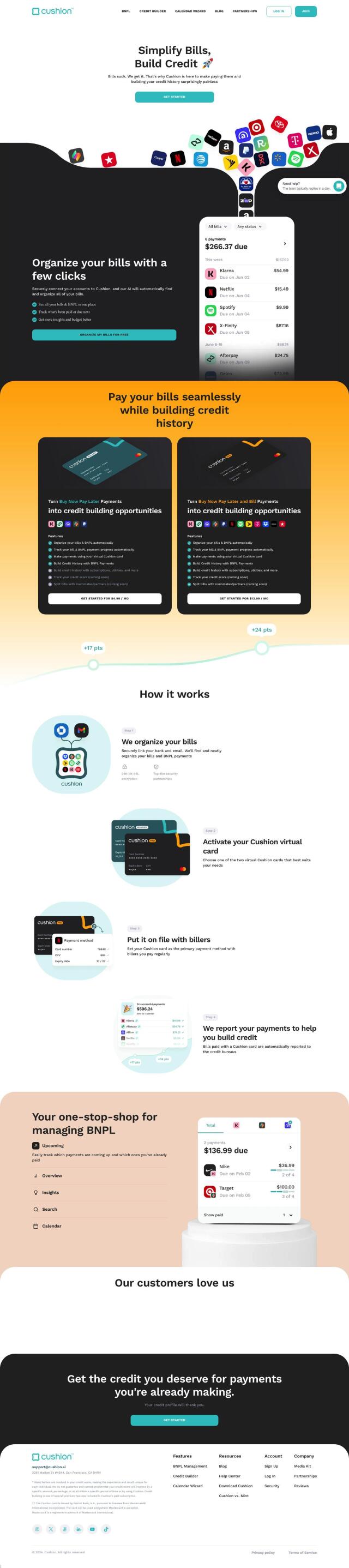

Cushion

If you're looking for a tool to help you manage your bills and make payments on time and build your credit history, Cushion is a top contender. It's a full-featured financial management tool that organizes bills, tracks paid and unpaid bills, and offers insights to help you budget better. It lets you manage payments with a virtual Cushion card that helps you build credit, and it tracks your credit score (soon), lets you split bills (soon) and integrates with your calendar so you never miss a payment. The tool also lets you manage BNPL payments, converting BNPL payments into credit-building payments.

Parthean

Another contender is Parthean, an AI-based financial management tool that automates and simplifies financial tasks. It offers features like real-time spending insights, personalized financial planning and a financial assistant. You can manage your savings, investments and debt in the app, and it offers real-time spending alerts and personalized investment insights. Parthean protects your data with bank-level encryption and anonymized data processing.

Kniru

For more personalized financial advice, check out Kniru, an AI-based financial advisor platform. The service offers hyper-personalized financial management advice on investments, spending, retirement, taxes and loans. It also offers features like personalized savings advice, bill due date reminders and overspending alerts. Kniru lets you link accounts easily and view organized dashboards to see what's going on with your money.

Sequence

And then there's Sequence, a financial router that links multiple financial accounts and automates your finances. It offers a dynamic UI money map that updates in real time, smart rules for custom automations and collaboration tools. Sequence helps you optimize your financial flow and make better decisions with features like instant transfers, scheduling and industry-leading security.