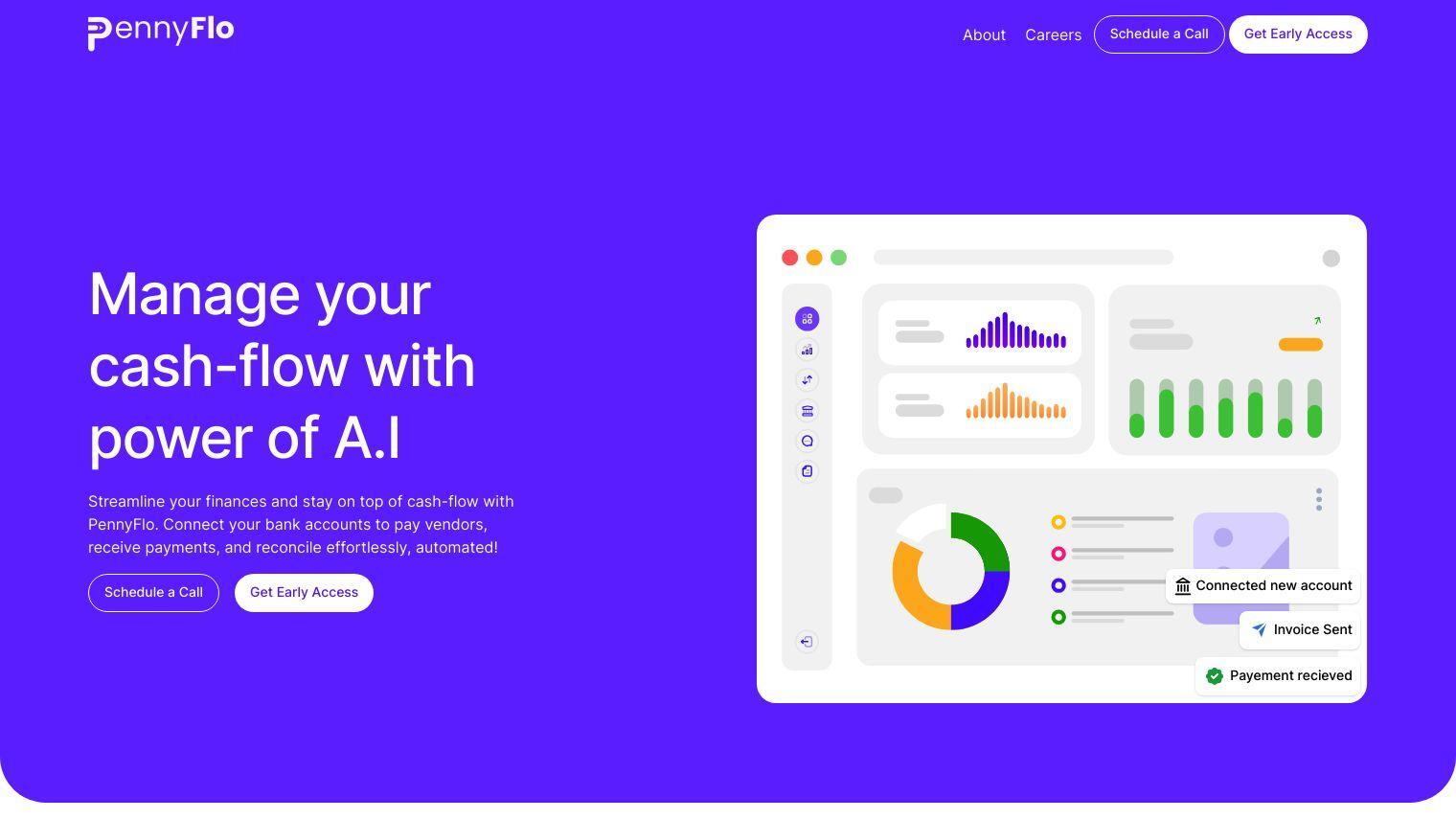

PennyFlo is a financial management suite that uses artificial intelligence to help small and medium-sized enterprises (SMEs) and startups better manage their cash flow. It lets you link bank accounts, pay suppliers, receive payments and reconcile transactions automatically.

Among PennyFlo's features are:

- Cash Forecasting: Uses AI to forecast future cash flow based on different scenarios so you can better plan for the near term and make more informed financial decisions.

- Cost Control & Budgeting: Tracks financials, sets employee budgets and customizes dashboards to help you better plan your finances.

- Connected Banking: Consolidates all bank accounts, accounting software and payment gateways into a single workspace that lets you easily track cash flow and get real-time updates.

- Automated Payments: Handles payments from local to international, with features like scheduled payments and automated invoicing through OCR technology.

PennyFlo is designed to make cash flow easier to manage, helping businesses keep a better handle on their finances and make more data-driven decisions. Other tools in the works include PennyPay, an AI-powered payment gateway, and PennyCollect, which speeds up collections and reduces late payments.

By connecting to other financial tools, PennyFlo offers a unified platform to streamline financial operations and keep a tight grip on cash flow.

Published on June 14, 2024

Related Questions

Tool Suggestions

Analyzing PennyFlo...