Question: I'm looking for a solution that can connect all my bank accounts and accounting software in one place, do you know of any?

Fortune App

If you want something that'll link all your bank accounts and accounting software in one place, the Fortune App could be a good fit. It's an AI-based accounting software that automates and analyzes your money situation across multiple banks around the world. It can link to more than 17,000 banks around the world, with features like automated bank connections, automated categorization, cashflow tracking and forecasting with monthly cashflow predictions. It's available on desktop, mobile and tablet computers, and has two pricing tiers.

PennyFlo

Another good option is PennyFlo, a financial management service geared for small to medium-sized enterprises (SMEs) and startups. It consolidates bank accounts, handles payments and automates transaction reconciliation. Among its features are AI-based scenario forecasting for cash flow planning, customizable dashboards for cost control, and automated payments. PennyFlo is adding other tools, too, like PennyPay for AI-based payments and PennyCollect for accelerating collections and reducing late payments.

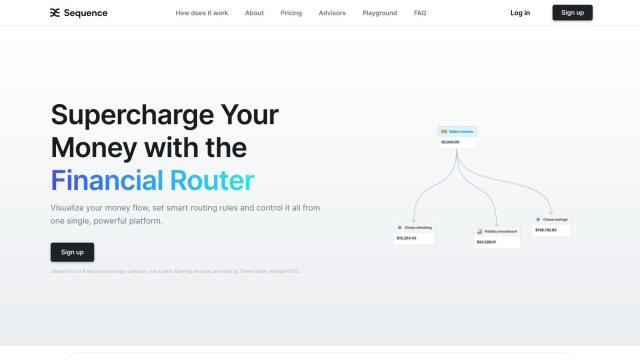

Sequence

Sequence is another good option, offering a financial router that automates and visualizes financial management by linking multiple financial accounts. It includes a dynamic UI money map for real-time financial tracking, smart rules for optimizing savings and investments, and industry-leading security with FDIC insurance up to $3,000,000. Sequence offers multiple pricing tiers, so it can accommodate different needs.

Fiskl

For small business owners, Fiskl offers an AI-based multi-currency accounting service that can handle more than 170 currencies. It automates bank transactions and reconciliation, integrates with multiple financial institutions, and tracks global invoicing and payments. Fiskl's interface is designed to be simple and usable on mobile devices, making it a good option for small businesses, freelancers and startups.