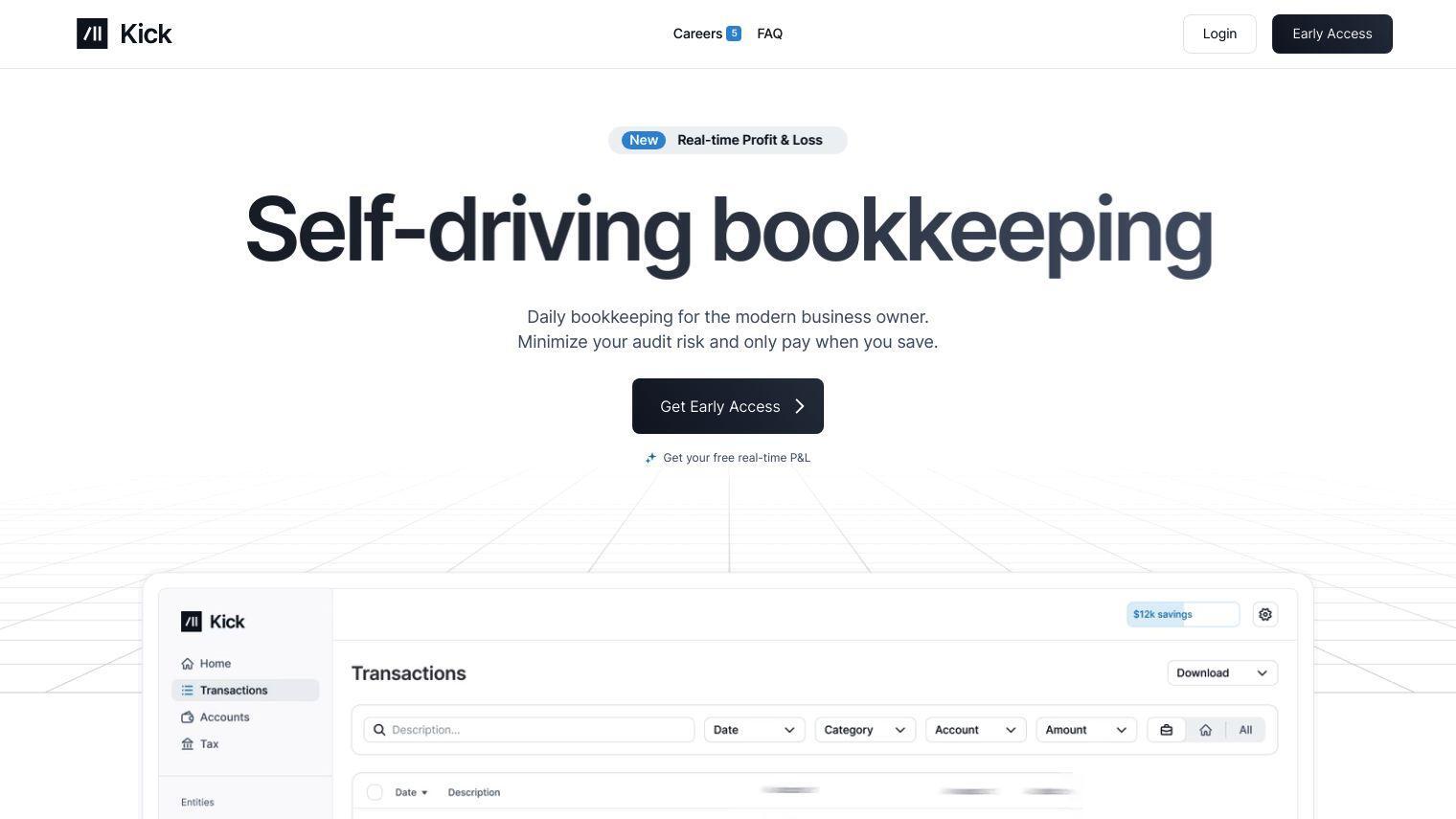

Kick is designed for today's business owner, providing daily bookkeeping that helps minimize audit risk and maximize tax savings. You only pay for the service when you save money, so it's a cost-effective way to keep your financial records in order.

Some of the features Kick offers include:

- Auto Categorization: Real-time transaction categorization reviewed by experts for accuracy

- Personalization: AI adapts to changes made by users

- Receipt Matching: Automated receipt matching eliminates manual processing

- Accurate Financials: Real-time profit and loss statements for making informed business decisions

Kick is designed to give you real financial confidence with features like:

- Accountant-Approved Reports: Shareable reports for tax purposes

- Monitor Spending: Identify and cut unnecessary business expenses

- Unlimited Accounts: High-level view across all entities, accounts, and teams at no added cost

Kick is built with security in mind, using AES 256-bit encryption and 3rd party penetration tests to protect your data. You can see what information is being shared across businesses and have control over your financial data.

Kick's pricing starts at $49/month after the initial $15,000 in business expenses. You can connect all of your accounts and businesses without any extra fees, making the service competitive and scalable.

Kick is geared for U.S.-based business owners looking to optimize their financial management and reduce audit risks. Although international support is not available yet, you can sign up for Early Access to stay up to date on future developments.

Published on June 14, 2024

Related Questions

Tool Suggestions

Analyzing Kick...