Growfin is an accounts receivable (AR) automation software designed to accelerate debt collection and collaboration among AR, sales and customer success teams. It's geared in particular for B2B finance teams that have to wrestle with a high volume of invoices, lowering days sales outstanding (DSO) and improving cash flow.

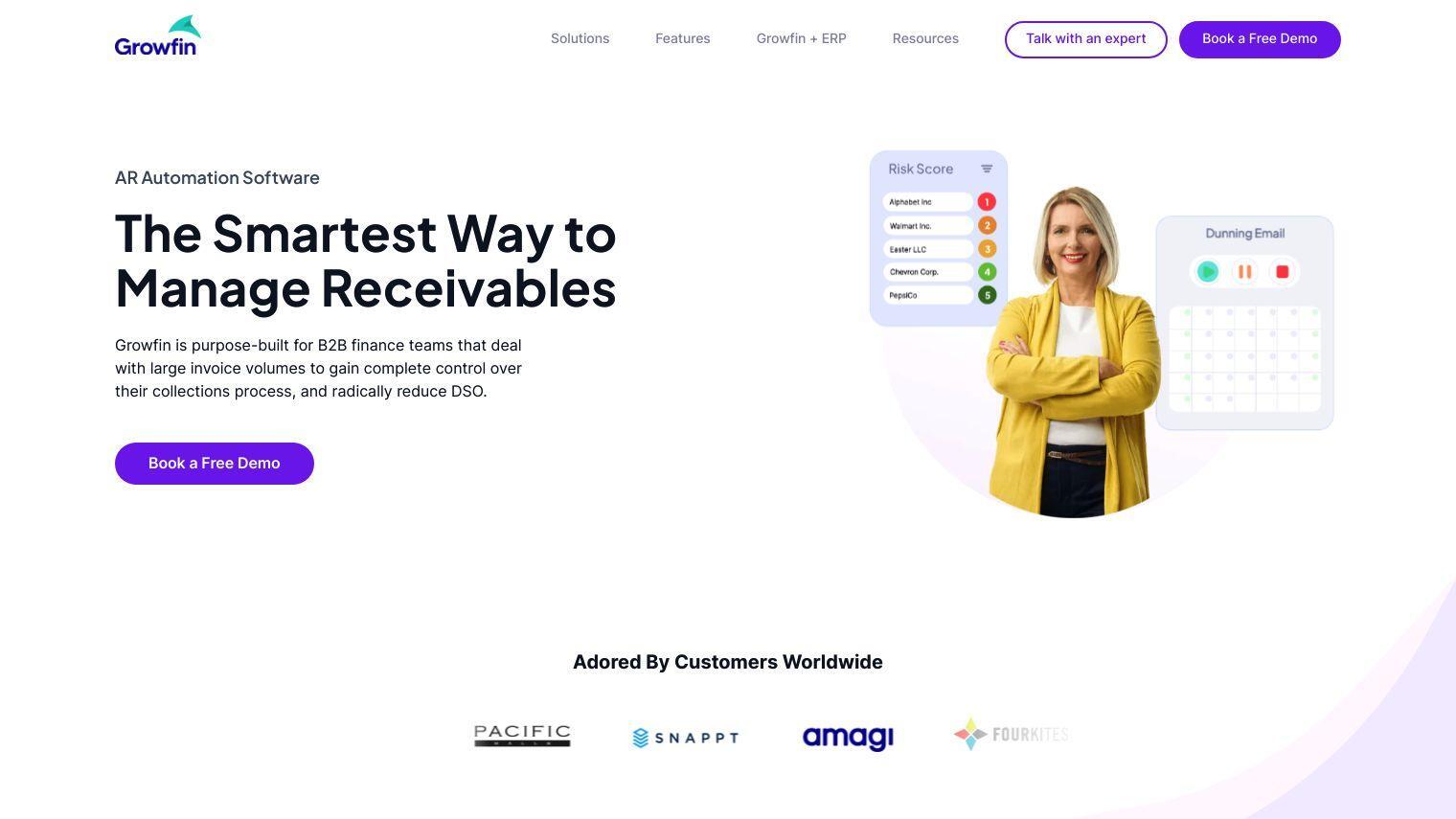

Growfin offers several features to improve the AR process:

- AI-based Account Prioritization: Automatically determine which accounts are most important for follow-up.

- Precision Dunning at Scale: Communicate with customers with personalized and targeted messages.

- Intuitive Collaboration Workflows: Facilitate communication among teams and stakeholders.

- Real-time Tracking & Analytics: Monitor collector performance, track payment history and analyze cash flow patterns.

- Automated Cash Posting: Record payments immediately and automatically extract remittances.

- Centralized AR Hub: Consolidate data from your ERP and create a single location for AR activity tracking and management.

Growfin promises to cut manual work by 60% and DSO by 33%. The company also offers customization options like custom AR automation, automated follow-up and risk detection. Integrations with common tools ensure data exchange and a broad range of features.

Growfin is for anyone who uses it, including CFOs, finance directors, controllers, AR managers, collection teams, customer success managers and account managers. It's for any company that wants to improve its accounts receivable process and accelerate its cash flow.

Published on June 14, 2024

Related Questions

Tool Suggestions

Analyzing Growfin...