Question: I need a solution that offers benchmarking and KPI tracking for startups to measure their performance against industry peers.

VentureInsights.ai

If you're a startup trying to compare your performance to that of your peers, VentureInsights.ai is a good option. This AI-based platform offers in-depth data to help you manage your deal pipeline, create investment reports and benchmark your portfolio. It includes features like Yardstick benchmarking, venture debt solutions, and AI-powered deal management, which can be used to manage your fundraising funnel and track KPIs.

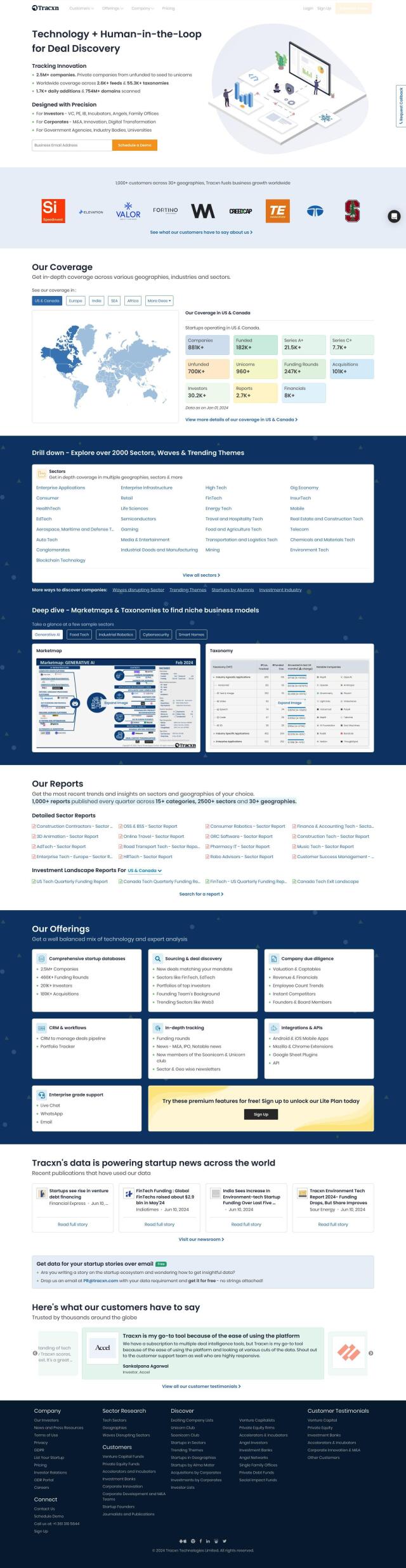

Tracxn

Another option worth considering is Tracxn, which is geared for venture capitalists, private equity firms and corporate development teams looking to track and analyze startups and emerging markets. It offers detailed data for deal sourcing and business development purposes for more than 2.5 million companies. Some of its features include detailed reports on various sectors, quarterly funding reports and access to company data like valuation and revenue.

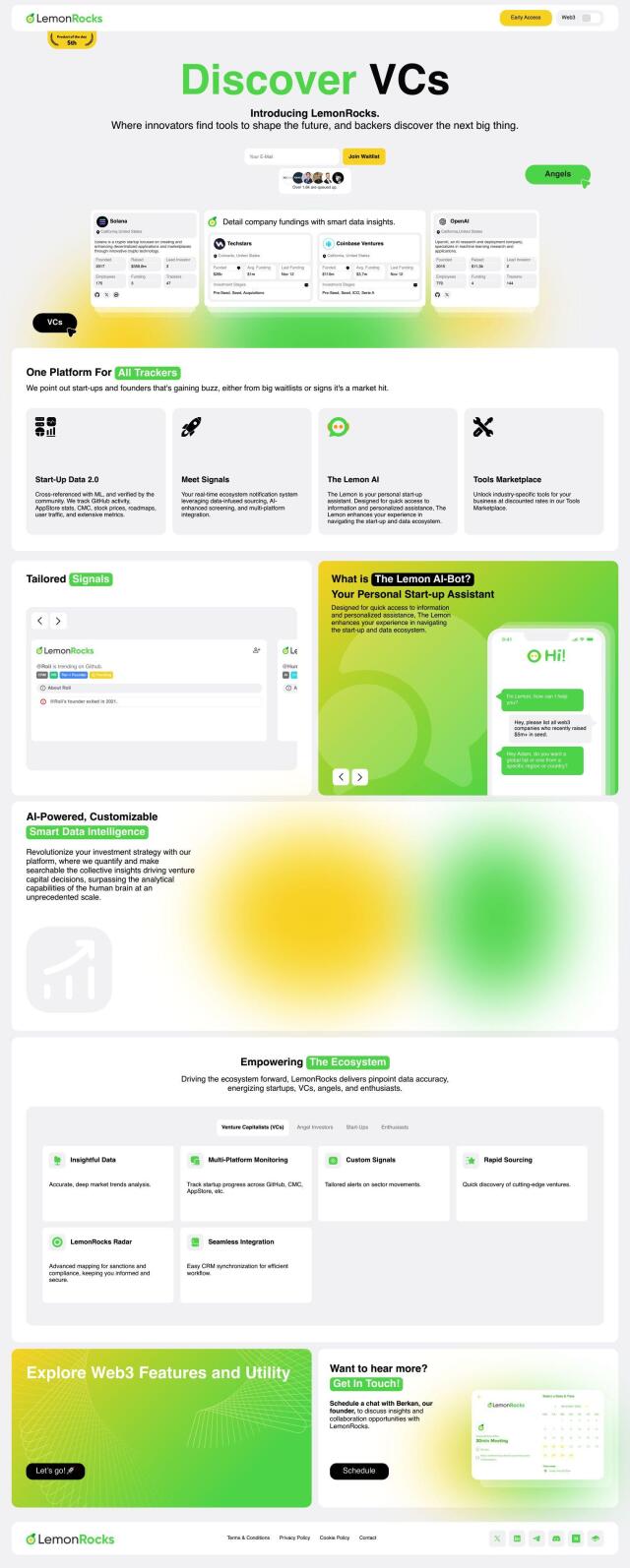

LemonRocks

If you prefer a data-first approach, LemonRocks uses machine learning algorithms to track and monitor start-ups with cross-referenced data. It includes features like GitHub activity tracking, AppStore statistics and real-time alerts. With tools for investment tracking, community insights and a sophisticated mapping system, LemonRocks offers a rich set of metrics to help you make informed investment decisions.