Question: How can I automate the process of screening and prioritizing startup pitch decks to find the best deals?

Accorata

If you want to automate the screening and prioritization of startup pitch decks to find the best deals, Accorata could be a good fit. This AI-powered deal sourcing platform is geared for early-stage investors who want to find and snag startups that fit their investment thesis from a variety of online sources and incoming pitch decks. It offers features like deal sourcing from more than 30 online sources, AI-augmented founder due diligence, and built-in deck processing from users' inboxes, so investors can make decisions faster.

Novable

Another good option is Novable. This AI-powered platform automates startup and innovation scouting, providing a suite of tools to find the best startups and do so efficiently. Novable uses AI to identify startups and human experts to validate the results for the best possible matches. It also includes in-depth analysis and benchmarking. It also connects you with startups through structured outreach and demo days, so you can get ranked lists of the most relevant startups curated to cut through the noise.

Flowlie

Flowlie is another tool worth considering, designed to streamline fundraising and investor management for venture capital founders and investors. It offers features like a Fundraising Hub, Benchmarking, and AI-Powered Deal Sharing that can help you screen deals faster, manage your investor network and make data-driven decisions. Thousands of founders trust Flowlie with a proven suite of tools to streamline the fundraising process.

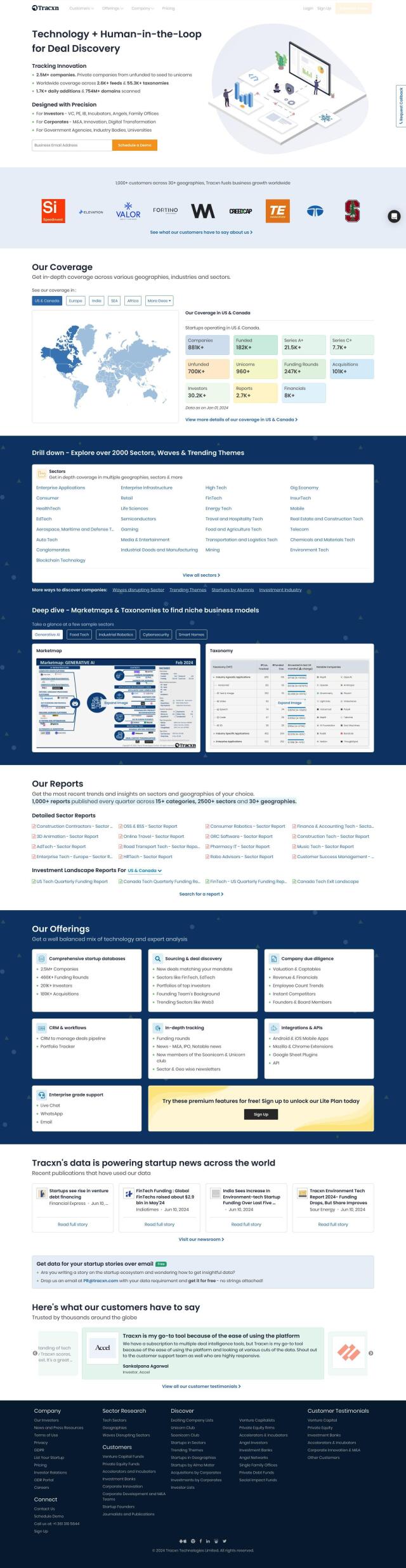

Tracxn

If you're looking for a more comprehensive tool, Tracxn offers more detailed information for deal sourcing and business development. It has data on more than 2.5 million companies and 55,300 taxonomies, and offers reports on different industries and quarterly funding reports. Tracxn includes startup databases, sourcing and deal discovery, company due diligence and CRM tools, so it's a good option for venture capitalists and private equity firms.