Question: I'm looking for a way to simplify the payment process for my customers, is there a solution that can auto-populate payment information from credit cards?

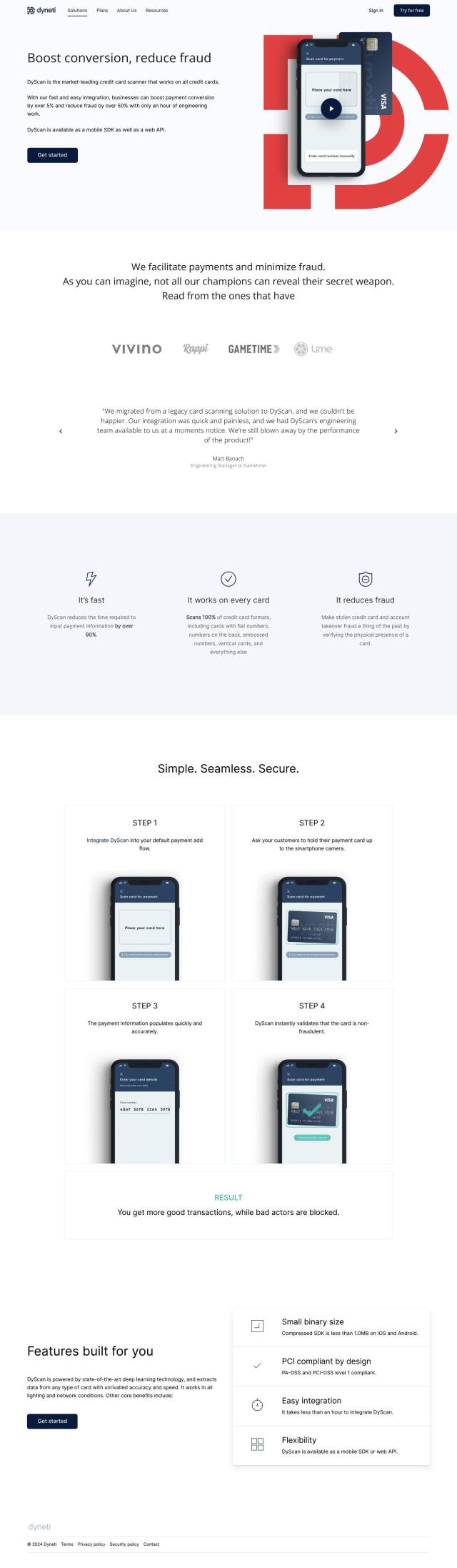

DyScan

DyScan is a good credit card scanning SDK that uses deep learning technology to read card data even in dim or network-slow conditions. It's PCI compliant and can be added in less than an hour. With DyScan, you can cut input time by more than 90% and get high accuracy with all credit card types. That makes it a good option for companies of all sizes that want to improve the payment process without sacrificing security.

Plaid

Another full-featured option is Plaid, a data network and payments platform that securely links people's financial data to apps and services. Payment initiation, real-time balance checks and identity verification are among the options that make Plaid payments smooth and trustworthy. It covers a broad range of financial use cases and has global coverage, so it's good for personal and business finances.

Slope

If you want to automate payments more, Slope offers flexible payment terms and embedded financing through APIs. It can handle credit card and ACH payments, guest checkout and same-day ACH, as well as embedded financing options like net terms and installments. Slope also automates AR processes, which can help you automate your customer order processing and remittance applications, reducing manual labor and increasing productivity.