Insurity

If you're looking for another Cover Genius alternative, Insurity could be a good option. Insurity offers a full cloud-based insurance software suite with modules for policy, billing and claims management. Its AI-driven insights and deep analytics can span the insurance lifecycle, making it a good option for property and casualty (P&C) insurance carriers and self-insured companies.

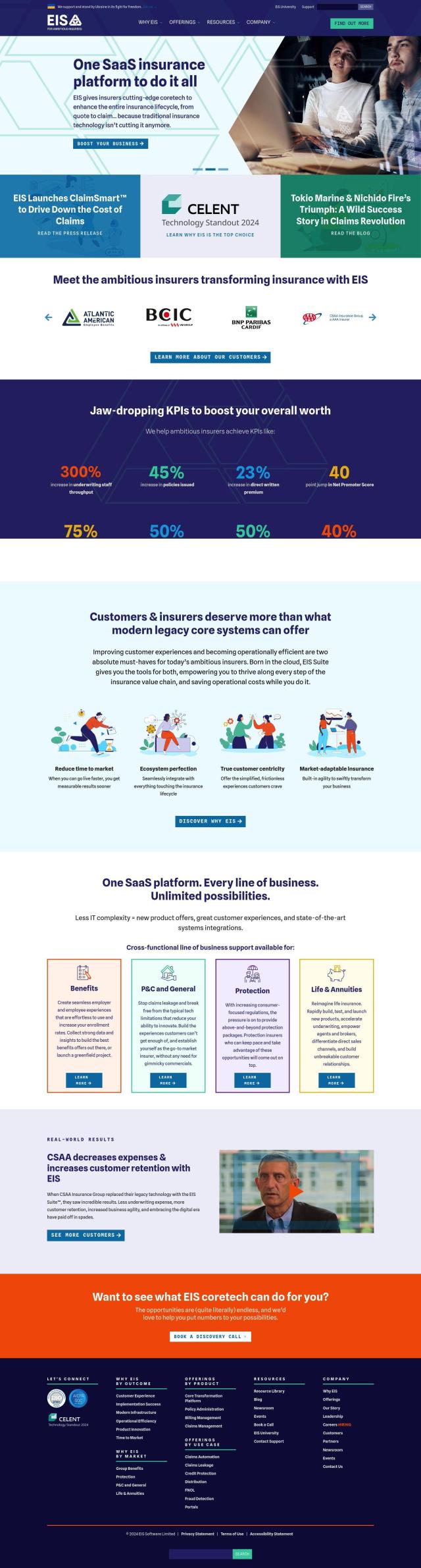

EIS

Another option is EIS, a cloud-native, API-first digital insurance SaaS platform. EIS offers a wide range of products and services, including policy administration, billing and claims management. Its open APIs and event-driven architecture let insurers break down data silos, automate work processes and integrate with third-party systems, making it a good option for those who want to modernize and optimize their operations.

CCC Intelligent Solutions

For P&C insurance, CCC Intelligent Solutions has a platform that connects data, advanced AI and ecosystem connections to offer personalized and efficient interactions. The platform is used by more than 35,000 companies and processes millions of historical data points, helping insurers make better decisions and improve the claims process and aftersales management.

Clyde

Last, Clyde offers an all-in-one platform to improve post-purchase interactions through extended warranties, product registration and issue resolution. With features like global warranties, AI-optimized pricing and streamlined claims processing, Clyde helps businesses build strong customer relationships and maximize lifetime value.