Question: Is there a tool that can help me reduce chargebacks and disputes on my Stripe account?

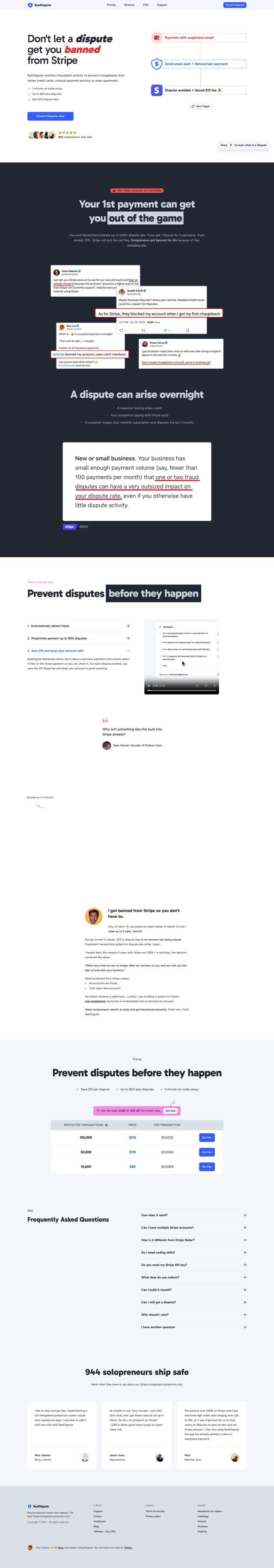

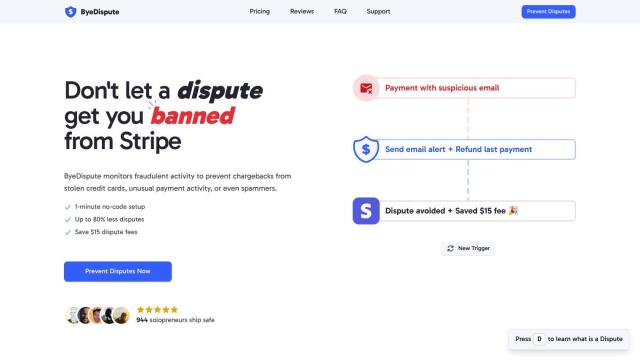

ByeDispute

If you want to cut chargebacks and disputes on your Stripe account, ByeDispute is worth a look. The service offers automated fraud detection and automated dispute prevention based on your payment patterns. It can be set up in a minute and offers features like automated fraud detection, dashboard alerts for suspicious payments and customizable actions against potential fraud. It charges by the number of transactions, so it should be affordable for solopreneurs and startups.

Hitprobe

Another good option is Hitprobe. It uses browser fingerprinting and threat detection to block fraud and abuse. It also can spot repeat customers and cut chargebacks by offering a fixed device ID. Features include client-side device detection, smart and custom rules, real-time counts of device and IP addresses, and a review queue. That makes it good for blocking fraud and abuse in a variety of situations, including chargeback prevention.

FlyCode

If you want something more elaborate, FlyCode is designed to optimize payments with AI-based dunning. It can integrate with payment gateways like Stripe to handle payment failures and optimize payment retries to minimize involuntary churn and maximize recurring revenue. By using FlyCode, businesses can insulate their subscription revenue from payment failures and maintain financial stability.

Verisoul

Last, Verisoul offers a fraud detection and prevention service that automates manual processes and consolidates vendor requirements. It offers features like device risk analysis, proxy and VPN detection, and bot detection to ensure legitimate user interactions. With automated decision-making and easy integration, Verisoul is good for businesses in many industries that want to improve their fraud prevention.