Question: I'm looking for a tool that provides comprehensive startup databases and deal discovery features for venture capitalists and private equity firms.

Tracxn

If you're looking for a broad startup database and deal discovery tool, Tracxn is a great option. The platform is geared for venture capitalists, private equity firms, investment banks and companies that want to track and analyze startups and emerging markets. It provides data for deal sourcing and business development, including startup databases, sourcing and deal discovery. It features detailed reports on more than 1,000 sectors, quarterly funding reports and access to company data like valuation, revenue and financials.

Dili

Another powerful option is Dili, an AI-powered deal platform for venture funds and private equity. Dili automates analyst work and offers a single source of truth data platform that can ingest data from sources like Google Drive, Dropbox, Pitchbook and CapIQ. It can generate custom reports with machine learning models and automatically generate private deal comps and benchmarks. The platform also identifies potential deal problems and offers SOC2 Type II certification for data security.

Novable

If you want a platform that combines AI-driven startup discovery with human expert validation, check out Novable. Novable automates startup and innovation scouting with in-depth analysis, benchmarking and vetting of startups. It connects you through structured outreach and demo days, presenting a ranked list of relevant startups vetted to cut through the noise. Users can submit search briefings in natural language and get relevant startup matches in two days.

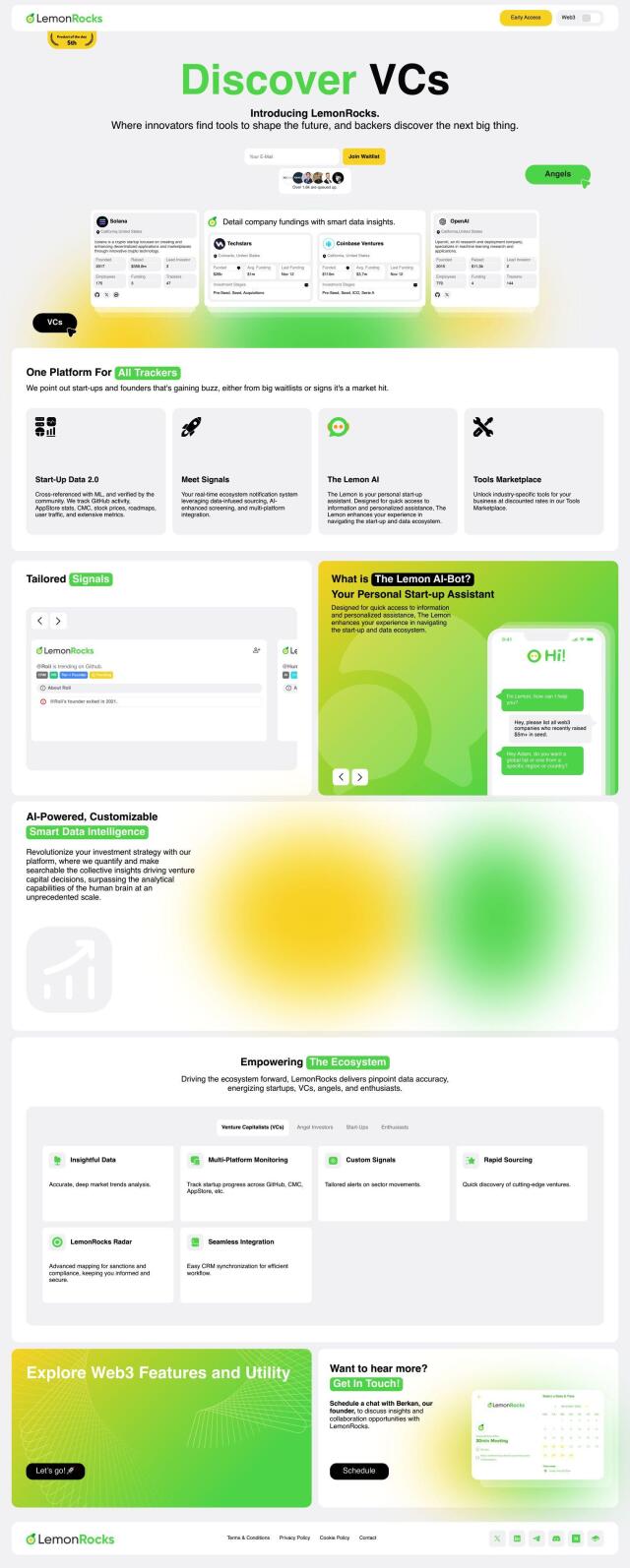

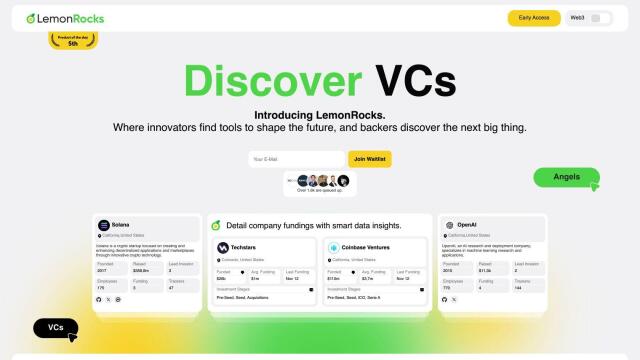

LemonRocks

Last, LemonRocks is a data platform that tracks and monitors startups with validated and cross-referenced data. It pulls in GitHub activity, AppStore statistics and CoinMarketCap data, among other sources. LemonRocks offers real-time alerts, a personal assistant and a sophisticated mapping system for sanctions and compliance. It's good for venture capitalists, angel investors and startups looking for detailed metrics and real-time updates to make investment decisions.