Question: Can you recommend a digital insurance platform that can help me modernize my infrastructure and improve operational efficiency?

EIS

If you're looking to modernize your insurance infrastructure and improve operational efficiency, EIS is a standout option. This cloud-native, API-first digital insurance platform is designed to help insurers innovate and optimize operations. With features like Policy Administration, Billing Management, Claims Management, and comprehensive portals, EIS aims to reduce time to market and break down operational silos. Its open APIs and event-driven architecture make integration with third-party systems seamless, enabling carriers to automate workflows and build strong data insights.

Insurity

Another excellent solution is Insurity, a cloud-based insurance software provider that offers a fully integrated platform for policy, billing, and claims management. Enriched with AI-powered insights, Insurity supports the entire insurance lifecycle, catering to property and casualty insurance carriers, managing general agents, and self-insured organizations. With a strong financial performance and over 500 customers, Insurity ensures scalability, security, and ease of integration, helping carriers manage emerging risks efficiently.

CCC Intelligent Solutions

CCC Intelligent Solutions is also a great choice, particularly for the Property and Casualty (P&C) insurance industry. It offers intelligent experiences through advanced AI and ecosystem connections, providing personalized and efficient interactions. The platform helps improve claims process efficiency, repair management, and customer experience, serving over 35,000 companies and processing more than $1 trillion in historical data.

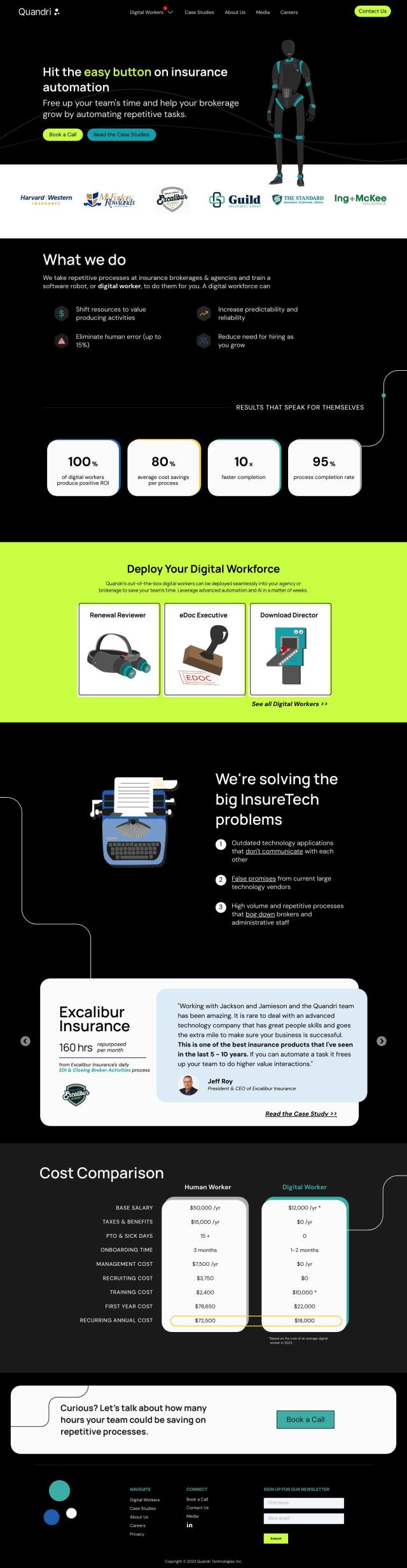

Quandri

For those interested in automation, Quandri provides digital workers that automate repetitive tasks for insurance brokerages. These bots perform tasks like policy renewals and document management, cutting costs and allowing staff to focus on higher-level work. With significant time savings and cost reductions, Quandri's automation solutions can help brokerages modernize their operations quickly and efficiently.