Question: Is there a digital banking software that offers modular and customer-centric solutions for financial institutions of all sizes?

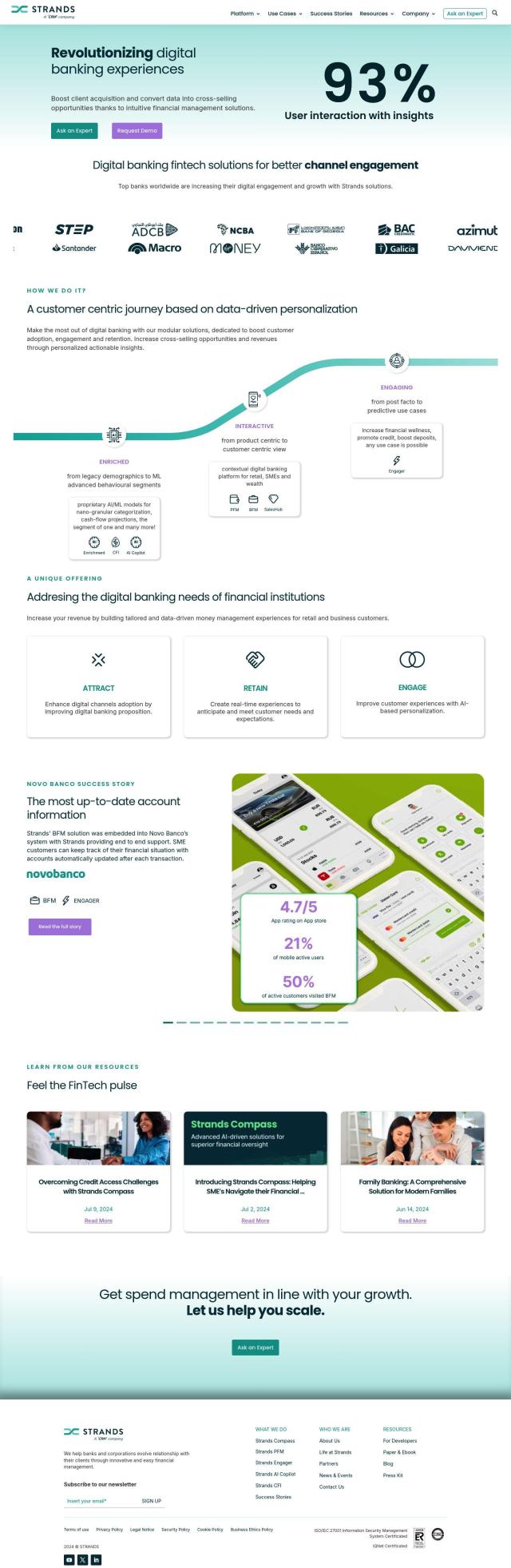

Strands

If you're a financial services company looking for a digital banking software package that's modular and customer-centric, Strands is worth a look. The company's platform uses real-time data to create insights and deliver personalized customer experiences. It offers core features like enriched insights, an interactive platform and engaging experiences, and is geared for retail and business customers. Strands offers flexible deployment options so smaller or larger institutions can easily scale and deploy the platform.

FintechOS

Another contender is FintechOS. The platform is designed to extend core banking and insurance systems, letting financial services companies innovate and launch new products and digital journeys without having to replace existing technology. It includes a low-code/no-code studio, a digital product factory and a composable data core for personalization and real-time analytics. FintechOS is designed to speed up time-to-market for new financial products, cutting complexity and costs and offering benefits like better onboarding and customer acquisition.

MX

If you're looking for a platform to connect financial accounts, get insights and build personalized money experiences, MX is a strong option. It securely aggregates and verifies financial data, enriches it with context, and lets businesses build personalized financial experiences. With more than 13,000 connections to financial institutions and fintechs, MX handles more than 170 billion transactions per day, making it a good option for improving engagement and growth.

InvestCloud

Last, InvestCloud offers a scalable and modular technology platform for digital wealth services. It offers best-in-class digital experiences across the wealth continuum, including advisor-led planning, client experience and self-directed trading. With features like rebalancing and billing, InvestCloud is designed to improve productivity and engagement across the wealth spectrum, and is good for financial services companies of all sizes.