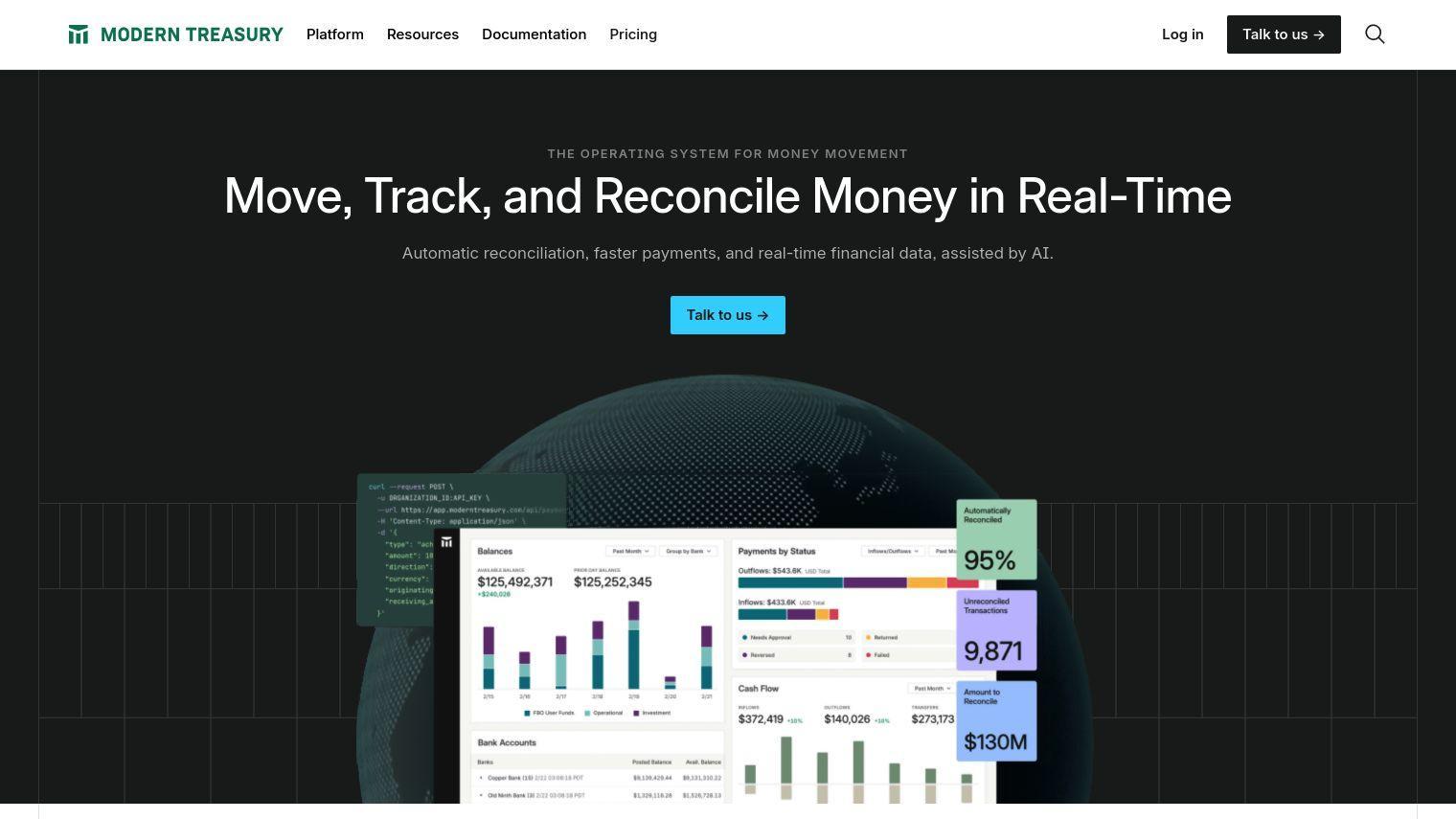

Modern Treasury handles payment rails like ACH, RTP, wires and others, so you can build products that process financial transactions with maximum efficiency. The company's platform is geared for finance teams, product teams and engineering teams, with a variety of tools to automate payment operations.

Modern Treasury offers real-time reconciliation, automated exception handling and a machine learning system that improves over time. For product teams, it offers a single API for connecting to more than 40 banks, using RTP and FedNow payment services, and sending payments in North America, Europe, the UK and Australia. The company also maintains a central ledger database for storing transactions and balances, providing a single source of financial truth and AI-powered insights.

Some of its features include:

- Real-Time Reconciliation: Achieve 100% reconciled with a detailed matching engine and AI-powered exception handling.

- One API for All Your Banks: Connect to multiple banks with a single API.

- Central Ledger Database: Store transactions and balances in a high-performance database.

- Enterprise-Grade Security: Support for RBAC, SSO, SCIM and SIEM, with SOC I, SOC II and PCI DSS compliance.

- Seamless Connectivity: Get up and running faster with pre-built integrations and flexible data ingestion options.

- Modular Architecture: Modernize your infrastructure at your own pace or address specific pain points.

- Robust Controls: Granular, conditional and sequenced approvals for payments and reconciliation.

Companies like Navan, C2FO and DriveWealth have used Modern Treasury to modernize their payment infrastructure, boosting efficiency and revenue.

Modern Treasury's pricing is designed to be predictable and to increase as your company grows. There are no per-transaction fees. The company offers flexible tiers to accommodate fast growth and new products. The company's enterprise plans are designed to accommodate large companies, with pricing that matches their scale.

Modern Treasury is geared for finance teams, product teams and engineering teams that want to automate and centralize payment operations, connecting to a variety of banks and payment systems. The company's features and enterprise-grade security make it a good fit for companies that want to move ahead of the payment infrastructure.

Published on July 8, 2024

Related Questions

Tool Suggestions

Analyzing Modern Treasury...