Question: Is there an insurance technology platform that can help modernize claims processing with AI-assisted capabilities and faster digital processes?

CCC Intelligent Solutions

If you're looking for an insurance technology platform that can help modernize claims processing with AI-assisted capabilities and faster digital processes, CCC Intelligent Solutions is a top choice. This cloud-based platform is designed for the Property and Casualty (P&C) insurance industry and offers intelligent experiences through advanced AI and ecosystem connections. Its features include intelligent claims process improvement, workflow optimization, and network management, helping insurers make better decisions and run more efficiently.

Quanata

Another top platform is Quanata, which offers contextual risk prediction and mitigation solutions. Quanata's AI-assisted modeling and real-time telematics enable risk-based acquisition innovations and claims modernization. It offers a unified, audit-certified subledger for fast operationalization and combines user and behavior-based data, contextual driving information, and telematics data to offer accurate and predictive risk insights.

Novo AI

Novo AI is another top choice, particularly for automating claims processing and document analysis. This platform uses generative AI to extract data from claim documents, match billable items, analyze price trends, and offer AI-based tools for coverage decisions. By optimizing claims processing and pricing strategies, Novo AI helps insurance companies increase operational efficiency and customer satisfaction.

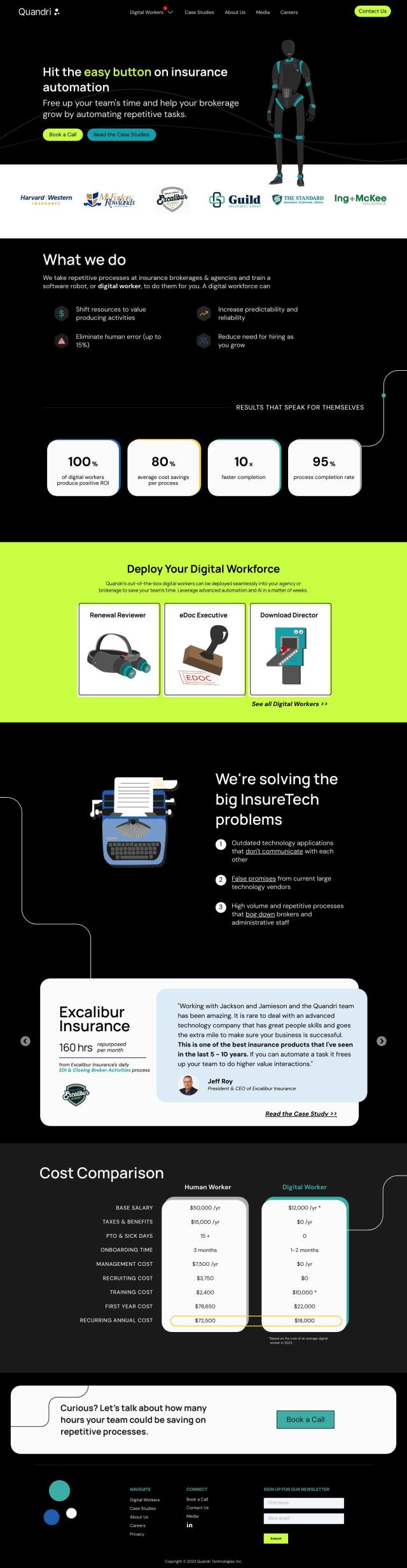

Quandri

For those looking to automate repetitive tasks in insurance brokerages, Quandri offers digital workers that can handle tasks such as policy renewals and document management. These AI-driven bots can significantly cut costs and redirect staff to higher-value work, making it easier for brokerages to modernize their operations and allocate resources more effectively.