Question: I need a virtual data room solution that provides AI-driven insights on bidder behavior and intentions.

Ansarada

If you're looking for a virtual data room solution that offers AI insights into bidder behavior and intentions, Ansarada is a great option. This all-purpose deal-making and transactional platform offers AI automation and insights to help you make better decisions in M&A, divestments, capital raisings and other transactions. It's got strong security and collaboration tools, too, so you can use it for the whole deal life cycle from strategy to post-deal integration.

Datasite

Another major player is Datasite, which is geared toward helping dealmakers close deals faster in a secure, collaborative environment. It's got sophisticated project management tools, AI-powered search and analytics, and is a good option for investment banks, corporate development teams and law firms. Datasite also has strong security certifications to help you comply with regulations.

Dili

If you want a more data-centric approach, Dili offers an AI-powered deal platform that aggregates data from many sources and automates due diligence and analyst work. It can generate custom reports, private deal comps and warn of potential deal problems with natural language processing and named entity recognition. That could be useful for venture funds and private equity firms that need to perform detailed due diligence and manage risk.

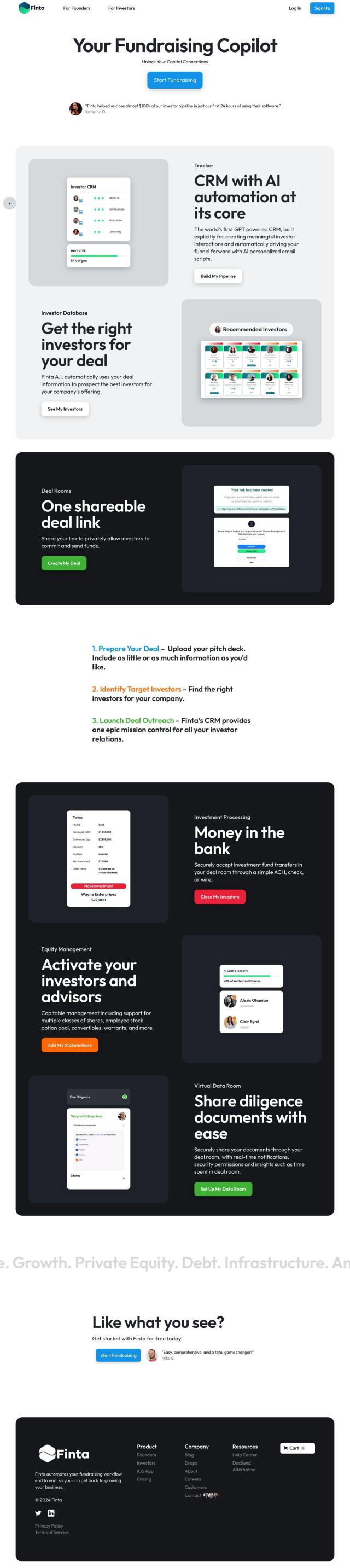

Finta

Last, Finta offers an AI-powered information retrieval system designed to speed up fundraising by automating deal sharing and matching with investors. With features like shareable deal rooms, real-time notifications and secure investment processing, Finta is good for companies that want to simplify their fundraising and connect with the right investors.