Question: Is there a system that can help mitigate risk in real estate investments by evaluating valuation and credit risk?

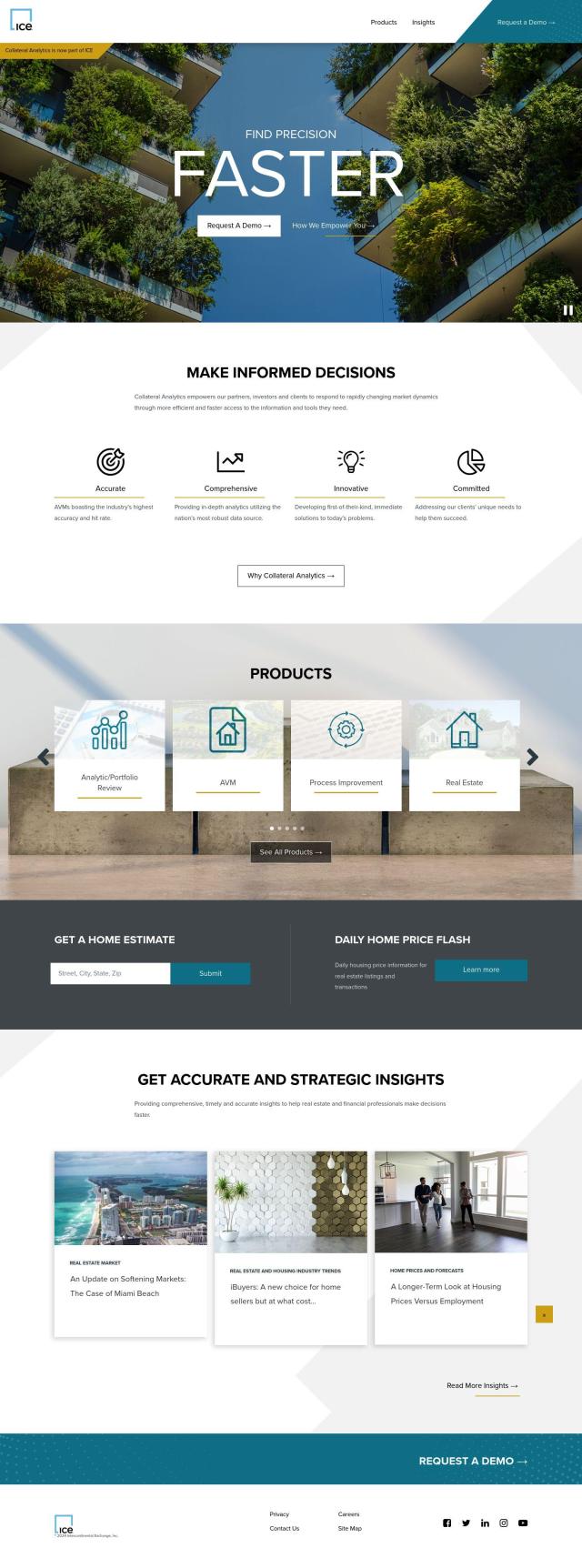

Collateral Analytics

If you're looking for a system to help you manage risk in real estate investments by assessing valuation and credit risk, Collateral Analytics is worth a look. The company offers a suite of products, including Automated Valuation Models (AVMs) for quick residential property assessments, and risk assessment tools like CA Risk Profiler and CA Credit Risk Model. It also offers detailed analytics and daily updated data through API/XML, batch, or website, so you can make decisions more quickly and with more confidence.

LexisNexis Risk Solutions

Another contender is LexisNexis Risk Solutions, which offers a broad range of risk management services. That includes credit risk assessment, financial crime compliance and fraud management. By combining a large repository of public and proprietary data, advanced analytics and proprietary linking technology, LexisNexis Risk Solutions helps companies identify and mitigate risk, ensure compliance and make more informed decisions about growth opportunities.

Binocs

If you're more focused on loan management and private credit funds, Binocs could be of particular interest. Binocs is an AI-based system that can extract financial information from documents, automate cash flow, covenant and ESG monitoring, and optimize loan book management. It includes automated document management, early warning systems, and integration with market intelligence platforms, all designed to help institutional lending stakeholders reduce risk and improve operational efficiency.

8VDX

Last, 8VDX offers an AI-based information system designed to work with credit investment workflows, in particular for mortgage-backed securities, asset-backed securities and collateralized loan obligations. It screens, analyzes and performs due diligence on investments, and uses sophisticated AI models to underwrite investments. That can dramatically cut analysis time and expense, and help credit investment companies make decisions and run their operations more efficiently.