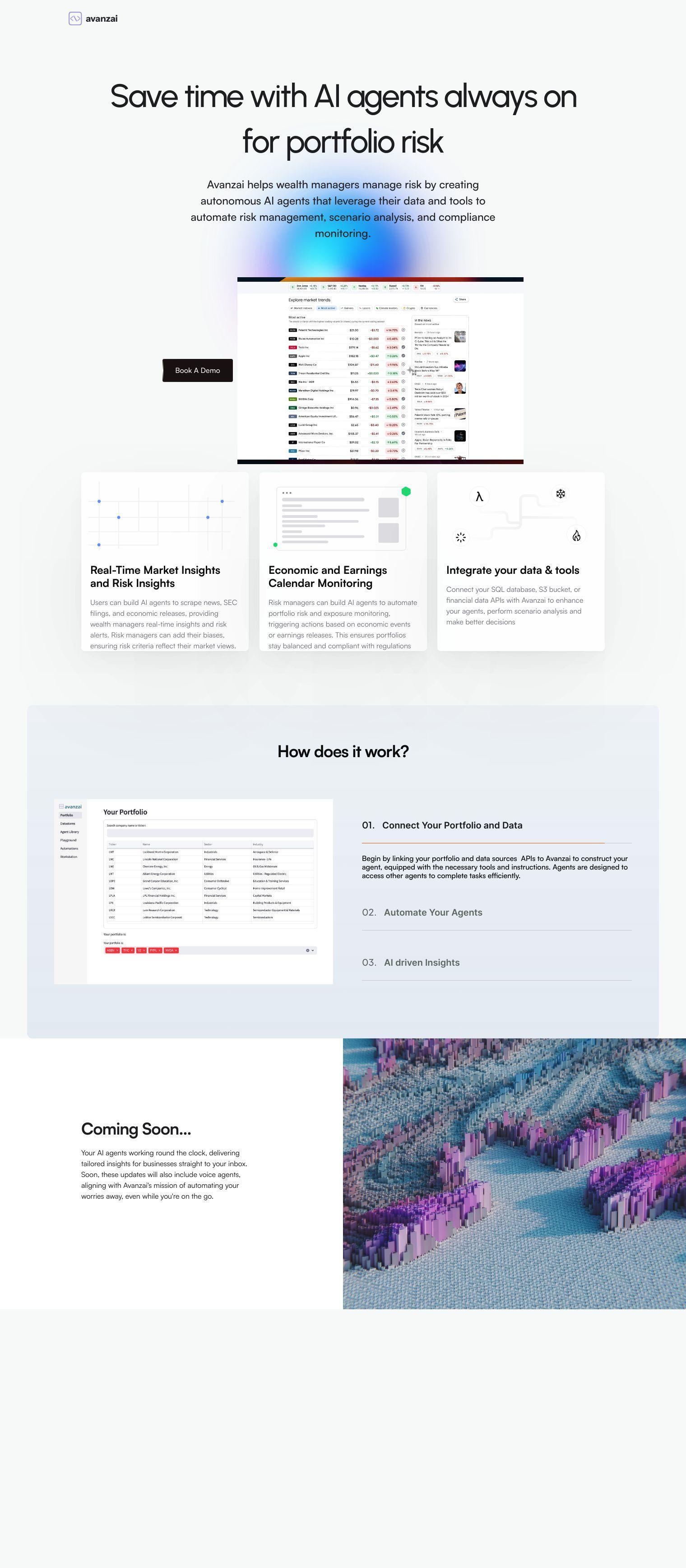

Avanzai offers AI agents to automate middle office workflows for asset managers and risk managers, for example to improve portfolio risk management, scenario analysis and compliance monitoring. The service lets people create autonomous agents that can gather data and use tools to generate real-time insights and risk alerts.

Some abilities include scraping news, SEC filings and economic releases for real-time market insights and risk alerts. Risk managers can also build their own biases into the risk criteria so it matches their market view. The AI agents can monitor portfolio risk and exposure and take actions based on economic events or earnings releases to maintain balanced and compliant portfolios.

Customers can plug in their own SQL databases, S3 buckets or financial data APIs to customize their agents and make decisions. It involves linking portfolio and data sources to Avanzai, designing agents with specific tools and instructions, and then automating them to get the work done.

Avanzai hopes to free up time by offering continuous AI-driven insights even when people aren't working. Although a public beta isn't yet available, interested parties can sign up for the waitlist to hear about developments, including voice agents that can deliver customized insights to people's inboxes.

Published on June 14, 2024

Related Questions

Tool Suggestions

Analyzing Avanzai...