Question: Can you recommend a payment infrastructure that can handle high volumes of transactions and provide detailed analytics?

ProcessOut

If you're looking for a payment infrastructure that can handle large volumes of transactions and offer detailed analytics, ProcessOut is definitely worth considering. ProcessOut has a powerful platform with features like AI Smart Routing, which automatically selects the best payment provider for each transaction, and a Monitoring system for performance analysis. The platform can handle thousands of transactions per second and offers enterprise-level security, making it a good option for businesses that need to ensure payments are running smoothly and securely.

ACI Worldwide

Another good option is ACI Worldwide, which covers a broad range of payment needs, including acquiring, enterprise payments and fraud management. With the ability to process more than 225 billion consumer transactions each year, ACI Worldwide has the scale and security for digital payment processing. The platform's responsible AI-driven fraud management helps businesses minimize risk and maximize customer satisfaction.

Inai

If you're looking for a single API to manage payments, Inai is a full-featured platform that integrates with many payment service providers (PSPs). It's got analysis tools like Optimize for deeper analysis and can handle up to 300 transactions per second with 99.99% uptime. Inai's flexible pricing tiers and support for more than 50 payment vendors make it a good option for e-commerce and subscription businesses.

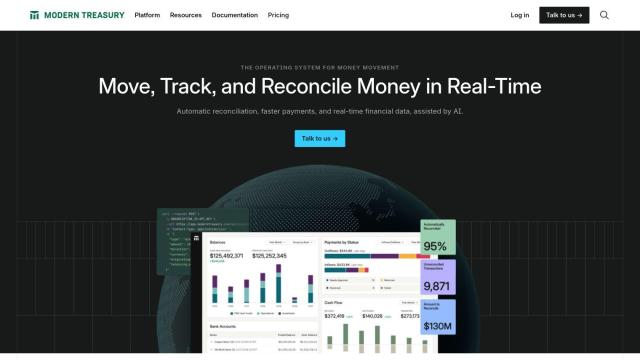

Modern Treasury

Last, Modern Treasury is designed to consolidate multiple payment rails like ACH, RTP and wires. It's got real-time reconciliation, automated exception handling and a machine learning system for optimization. With a single API that connects to more than 40 banks, Modern Treasury offers a centralized and scalable payment management system that's good for finance teams and product teams.