Question: Can you recommend a digital safety solution that includes identity theft protection and financial fraud monitoring?

Aura

For more general digital protection that includes identity theft protection and financial fraud monitoring, Aura is a good option. Aura's features include financial fraud protection, identity theft protection, privacy assistant, parental controls, spam call protection, VPN, antivirus and password manager. It offers real-time alerts for suspected fraud and a $1 million insurance policy for eligible losses. Aura offers different plans for different people, including Family, Couple, Individual and Kids plans, with a 60-day money-back guarantee and 14-day free trial.

IBM Security Trusteer

Another good option is IBM Security Trusteer. This cloud-based service uses AI and machine learning to spot fraud and thwart malicious users across all channels. It offers real-time fraud detection, identity risk assessment, mobile device risk assessment and malware protection. Trusteer's continuous digital identity assurance helps businesses reduce fraud risk and improve customer experience, and it's a service that can scale to meet the needs of financial fraud monitoring.

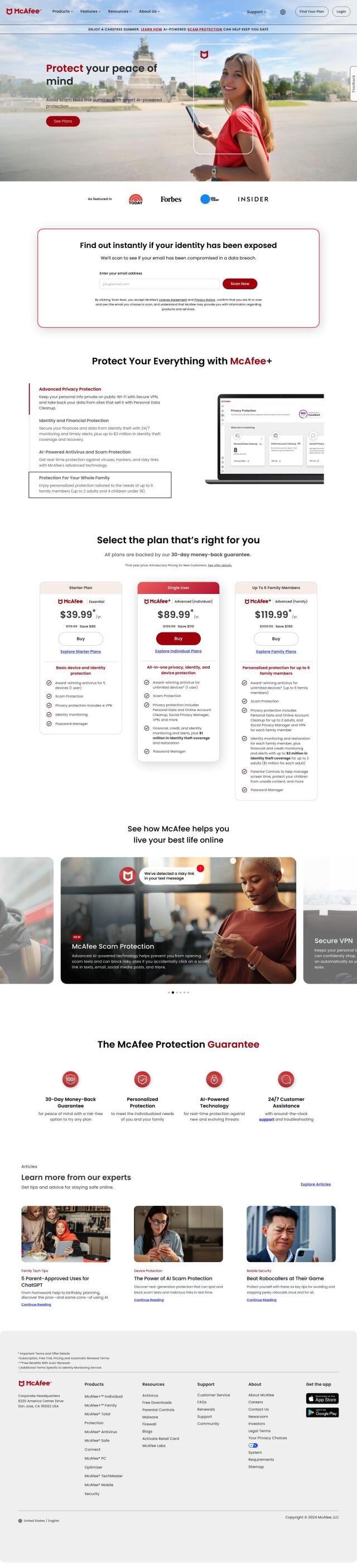

McAfee

McAfee also offers general digital protection with features like scam protection, secure VPN, personal data cleanup, identity monitoring, password manager and parental controls. With different plans for different needs, including Starter, Individual and Family plans, McAfee offers 30-day money-back guarantees and 24/7 customer support, so you can try it risk-free and get help if you need it.

Incognia

If you're looking for something more focused on identity protection, check out Incognia. Incognia's persistent device fingerprinting and indoor location intelligence helps thwart fraud and keep your digital journey safe. It's good for businesses like food delivery, ride sharing and financial services, with features like frictionless risk solutions, user verification and listing verification. It offers flexible pricing and good results, so it's a good option for serious identity theft protection.