Question: Is there a data analytics partner that can provide insights to help me refine my life and annuity portfolios and maximize value?

Verisk

If you're looking for a data analytics partner to help refine your life and annuity portfolios and maximize value, Verisk is an excellent choice. Verisk is a data analytics and technology partner to the global insurance industry, offering a wide range of tools and services designed to improve the insurance value chain. The platform excels in portfolio-level optimization for life and annuity, using AI-powered risk modeling and advanced analytics to help insurers make better decisions and drive growth.

Toggle Terminal

Another strong option is Toggle Terminal, an advanced analytics platform that allows users to ask complex questions of data using natural language. It features Scenario Testing for rapid market hypothesis testing, Asset Intelligence for automated insights, Chart Exploration for natural language querying of data visualizations, and Idea Discovery for surfacing relationships between companies. This platform is particularly geared towards institutional investors and wealth management professionals, providing deep insights without requiring technical expertise.

Qlik

For a comprehensive suite of data integration, analytics, and AI, consider Qlik. Qlik offers a rich data fabric and deeper insights through end-to-end data integration and analytics capabilities. Its core features include data streaming, application and API integration, data lake creation, and AI-powered features like AutoML and Qlik Staige for no-code predictive AI application development. This makes it a versatile tool for various industries and roles, including portfolio management.

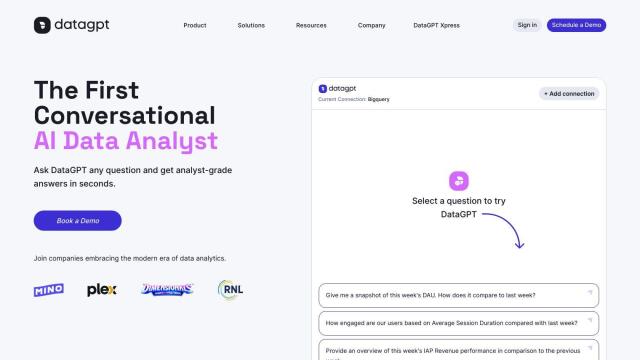

DataGPT

Lastly, DataGPT is a conversational AI data analyst designed to provide analyst-quality answers in seconds. It integrates with a wide range of data sources, offering features like automated insights, context awareness, and a data navigator for exploration. This tool is ideal for making fast, data-driven decisions and optimizing growth metrics, making it a valuable addition to your portfolio management toolkit.