Question: Is there a solution that offers company due diligence reports, including valuation, financials, and competitor analysis?

Dili

If you're looking for a solution that provides comprehensive company due diligence reports, including valuation, financials, and competitor analysis, Dili is definitely worth a look. This AI-powered deal platform automates analyst workflows by pulling data from a variety of sources like Google Drive, Dropbox, Email, Pitchbook, and CapIQ. Dili can create private deal comps, benchmarks, and custom reports using sophisticated machine learning models and alert you to potential deal problems like high spend and legal issues. With SOC2 Type II certification for data security, Dili has been adopted by over 500 users with $50B+ AUM.

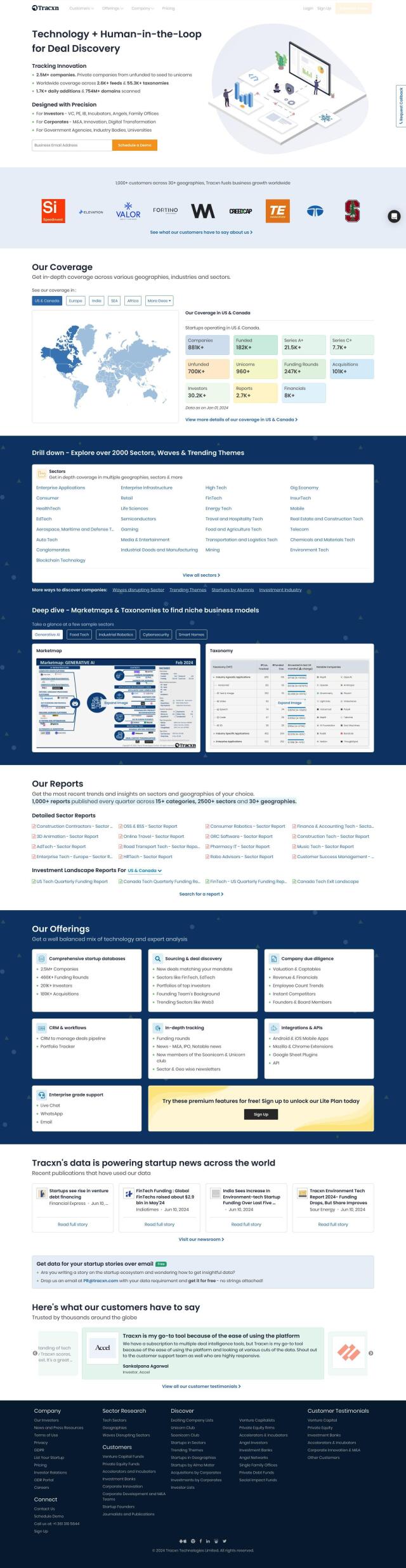

Tracxn

Another good option is Tracxn, which offers detailed information for deal sourcing and business development. It covers over 2.5 million companies and offers detailed reports on more than 1,000 sectors. Tracxn includes startup databases, CRM, workflows, and APIs. You can access company data such as valuation, revenue, and financials, as well as quarterly funding reports, making it a great tool for due diligence and competitor analysis.

FinChat

If you're looking for a more financial data and analytics focus, FinChat combines institutional-quality financial information with conversational AI to transform research. It offers in-depth financial data vetted by human equity analysts, including financials and estimates from S&P Market Intelligence. FinChat includes advanced data visualization, DCF modeling, and AI-driven competitor comparisons, making it a great tool for financial analysis and due diligence.

Tracxn

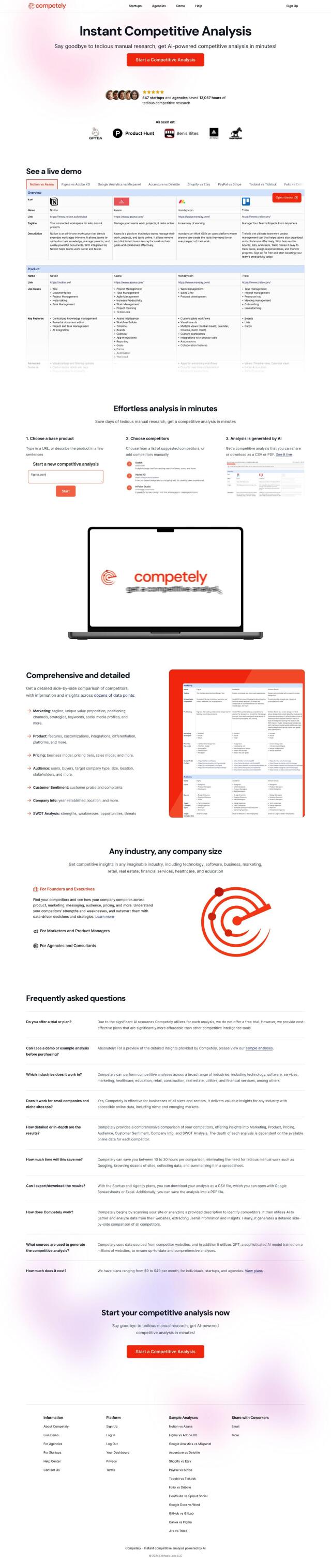

Finally, check out Tracxn for a more detailed competitor analysis. Competely offers side-by-side insights into marketing, product, pricing, audience, customer sentiment, and SWOT analysis across multiple data points. It's geared for founders, executives, and marketers who need data-driven insights to inform decisions, compare competitors, and build go-to-market strategies.