Question: Can you recommend a tool that helps manage deals, operations, and finance for commodity trading teams?

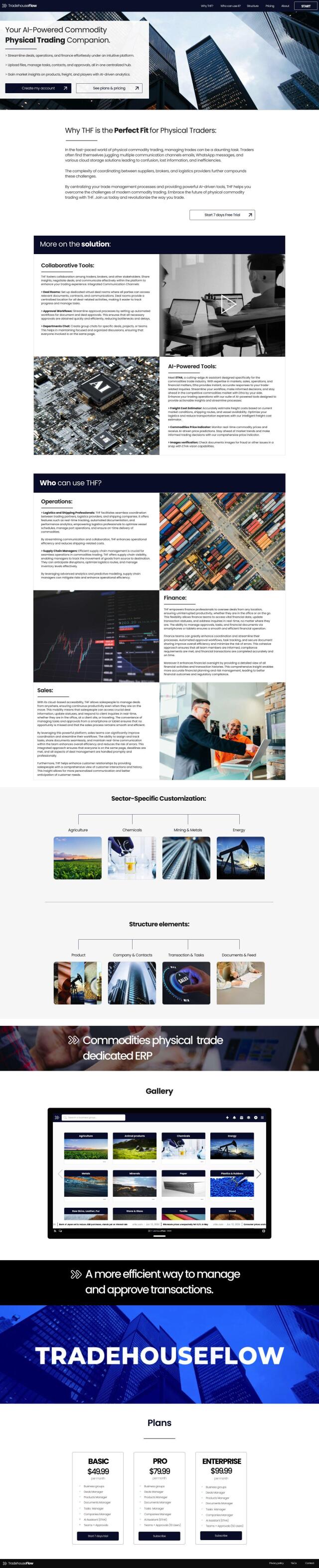

Tradehouseflow

For managing deals, operations and finance for commodity trading teams, Tradehouseflow is a good example of an all-in-one solution. The AI-powered platform automates and simplifies physical commodity trading operations with tools like deal rooms, automated approval workflows and a freight cost estimator. It also tracks commodity prices in real-time with AI-generated forecasts, making it a good option for improving productivity and decision-making.

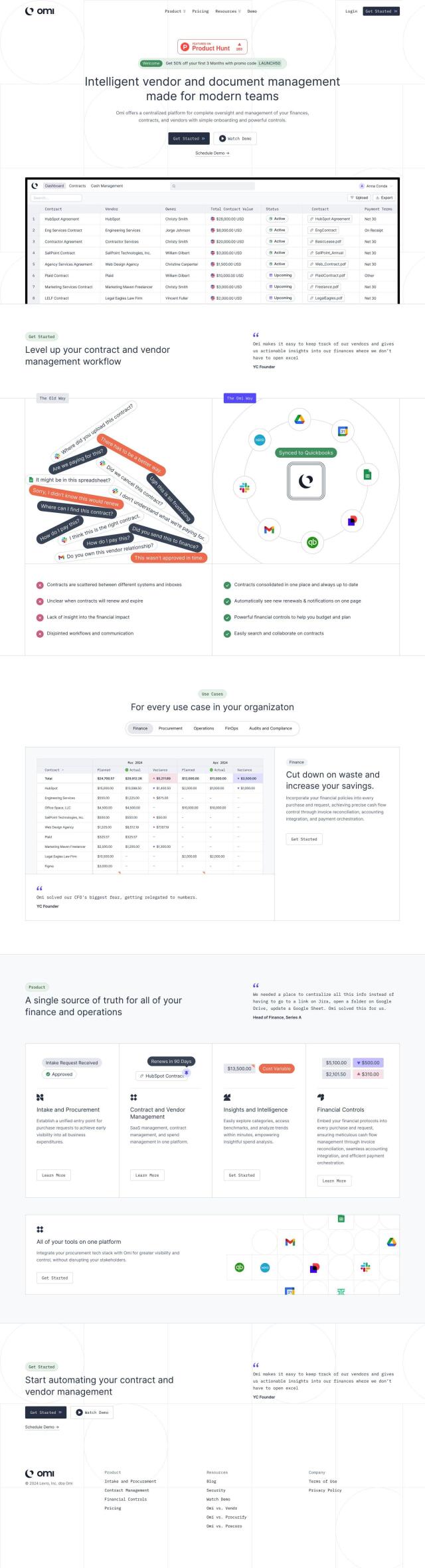

Omi

Another good option is Omi, which offers a unified platform for managing finances, contracts and vendors. Omi centralizes contract management, automates renewal notifications and offers detailed financial controls for managing cash flow. It integrates with tools like QBO/Xero, Docusign, Slack and Google/Microsoft Calendar to help teams work more efficiently and reduce manual work.

Datarails

For financial planning and analysis, Datarails is a good option for automating data consolidation, financial reporting and budgeting. It integrates with common accounting software, ERPs and CRMs, and offers features like data visualization and AI-driven insights. The platform is designed to help finance teams work more efficiently and focus on strategic insights and business growth.

Coupa

Finally, Coupa offers a cloud-based spend management platform that automates and simplifies operations across procurement, supply chain, finance and IT. Coupa automates source-to-pay processes, treasury management and procure-to-pay with AI-driven automation, offering a single view into global cash positions and driving high adoption and on-contract spend. The platform helps businesses improve productivity, collaboration and growth.