Question: I need a way to build credit without a traditional credit history, is there a service that can help?

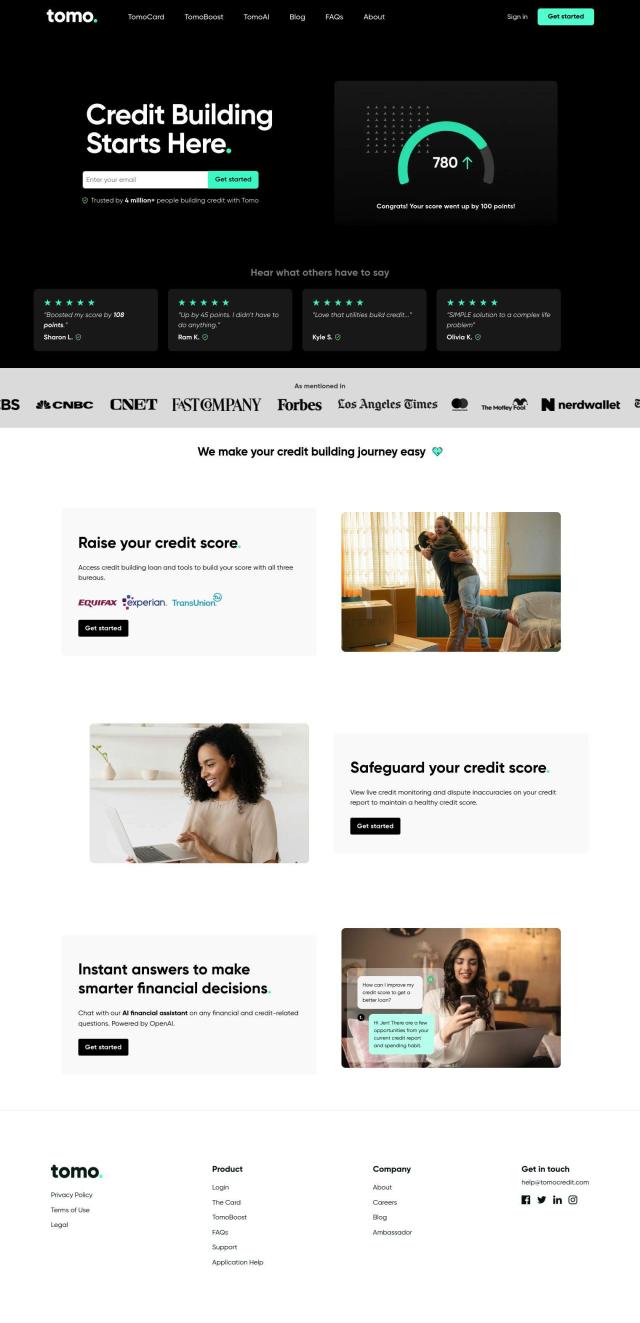

TomoCredit

If you're looking for a service to help build credit even if you don't have a traditional credit history, TomoCredit could be a good choice. TomoCredit relies on alternative data sources and its own proprietary algorithm to evaluate creditworthiness, which means people without a traditional credit history can use it. It offers a number of features, including credit-building tools, credit monitoring and instant financial advice through an AI-powered chatbot. And the Tomo card, with its 7-day automatic payment option and spending limit of $30,000, can help you keep your spending in check.

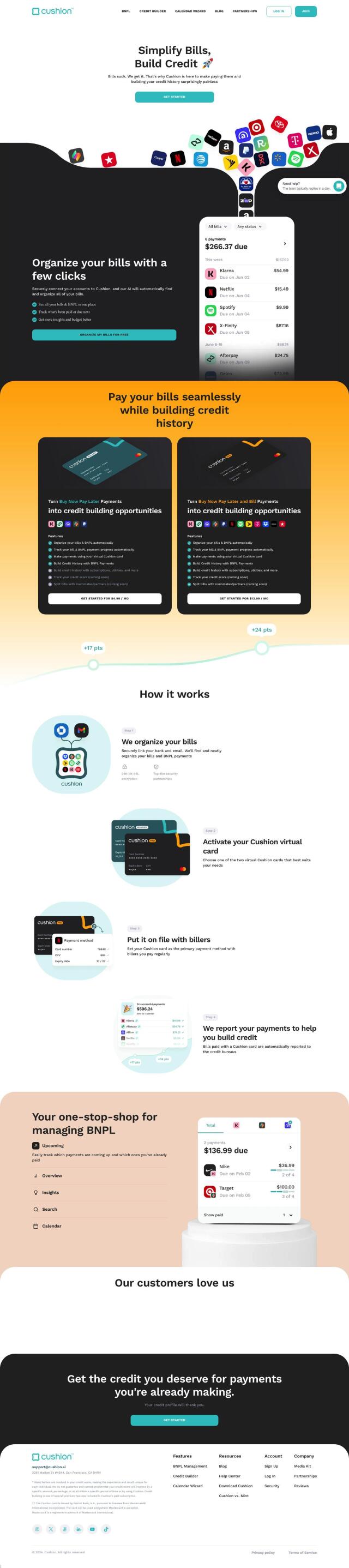

Cushion

Another option is Cushion, which helps you manage your bills and build credit history by securely linking accounts. It has features like bill tracking, payment management through a virtual Cushion card, credit score tracking and calendar integration to help you pay on time. Cushion also offers credit-building opportunities through bill payments and cashback rewards, so it's a good all-purpose financial management tool.

Nova Credit

For a more general credit infrastructure option, Nova Credit offers a service that aggregates consumer credit data from a variety of sources, including international credit bureaus and payroll systems. Nova Credit's services like Cash Atlas for credit risk assessment and Credit Passport for fast approval can be useful for building credit quickly and safely. It's designed to help lenders extend credit to people who might not qualify otherwise, so it's a good option for people trying to establish a credit history.

TransUnion

Finally, TransUnion offers a range of credit protection tools, including daily credit score updates and credit monitoring. With tools like CreditCompass insights and Credit Lock Plus, TransUnion helps people keep their credit score healthy while also protecting against fraud. That could be useful for people who want to keep an eye on their credit health while building a good credit profile.