Question: How can I automate fraud detection and prevention on my e-commerce platform?

Verisoul

If you want to automate fraud detection and prevention on your e-commerce site, Verisoul is a good option. The all-in-one platform automates manual processes and consolidates vendors to handle a range of fraud types, including repeat sign-ups, bot accounts and payment fraud. Verisoul assesses a range of signals, including device risk, proxy detection and face matching, to ensure each user is real and unique. It can provide automated decisions, workflows and AI investigation analysts, and it's easy to integrate with a variety of pricing tiers to suit different user bases.

Dodgeball

Another powerful option is Dodgeball, an orchestration platform for e-commerce and fintech companies. It provides a single integration process to rapidly deploy fraud solutions, with features like end-to-end visibility into user journeys, A/B testing and continuous optimization. Dodgeball integrates with identity verification and account opening services, so it's a good choice for enterprise e-commerce companies and fintech platforms that want to minimize friction and maximize revenue.

Flagright

If you're in fintech or banking, Flagright offers an AI-native AML compliance and fraud prevention platform. It includes automated case management, real-time transaction monitoring and AI-based risk scoring. The platform is designed to reduce manual task hours and false positives, so businesses can scale with confidence.

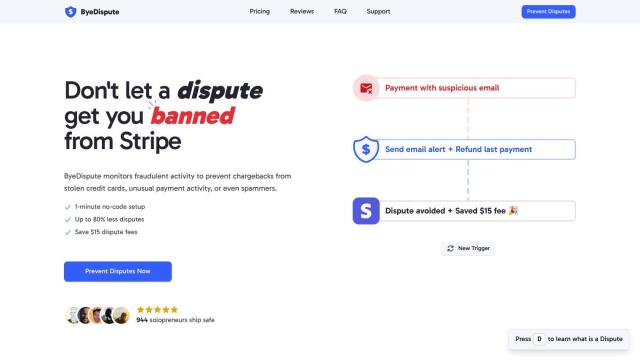

ByeDispute

Last, ByeDispute is a specialized fraud detection and prevention system that monitors Stripe accounts for payment patterns that indicate fraud. It can be set up with no programming and can take automated action to prevent disputes and fees. It's good for solopreneurs and startups using Stripe who don't want to deal with disputes and chargebacks.