Flowlie

If you're looking for another alternative to VentureInsights.ai, Flowlie could be a great choice. Flowlie is a data-driven platform that helps venture capital founders and investors manage fundraising and investors. It has tools like a Fundraising Hub, Benchmarking, Personalized Investor Database, and Deck Sharing to help founders raise money with confidence and speed. For investors, it offers tools for accelerated deal screening, tracking their investor network, and AI-Powered Deal Sharing. Flowlie has been used by thousands of founders from more than 70 countries who have raised more than $440 million on the platform.

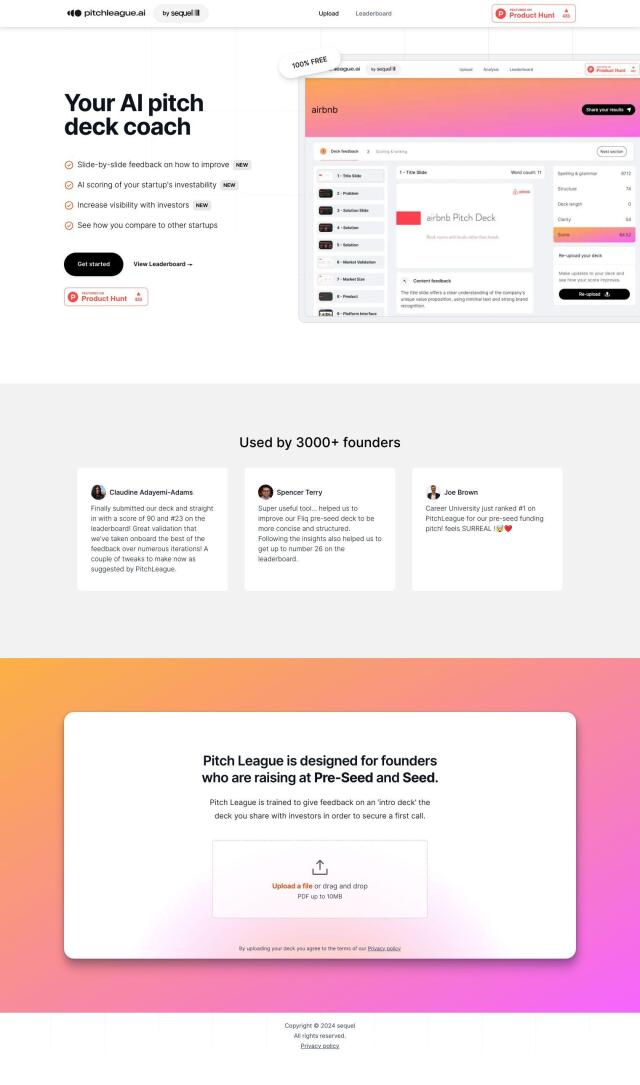

Score My Deck

Another alternative worth considering is Score My Deck, an AI-based information extraction system geared specifically for early-stage startups, specifically pre-seed and seed founders, to improve their pitch decks. The platform provides instant feedback on pitch decks so founders can prepare for investor objections and build persuasive pitches. It includes features like understanding investor thought processes, anticipating VC objections, and writing fundraising emails, all with the goal of optimizing the fundraising process.

Finta

For those looking for secure and shareable deal rooms, Finta is another option. It uses AI-based automation and a CRM to personalize email scripts and move the investment funnel forward. Other key features include AI-based investor matching, secure investment processing, and virtual data rooms with real-time notifications and permission control. Finta is designed to automate and streamline fundraising processes so founders can better manage deal flow and connect with the right investors.

Accorata

Last, Accorata is an AI-based deal sourcing platform for early-stage investors. It uses AI technology to rapidly process deals and make decisions quickly. The platform includes features like deal sourcing from more than 30 online sources, AI-boosted founder due diligence, and sovereign technology that complies with European Data Protection standards. Accorata offers different pricing plans to accommodate different investor needs and ambitions.