Question: Can you recommend a tool that helps venture capitalists and angel investors make informed investment decisions?

Evalify

Evalify is an AI-based system that evaluates legal risk for early-stage startups based on patent filings. It offers a quick preliminary freedom-to-operate score and report so investors can assess patent infringement risks and avoid legal problems. It can be useful for venture capitalists and angel investors who want to speed up due diligence and make more informed decisions.

VentureInsights.ai

Another option is VentureInsights.ai. This AI-based investment and fundraising platform connects startups and investors and offers a wealth of data to help you manage deal pipelines and generate investment reports. It includes features like fundraising CRM, smart investor reporting and co-investment tools, so it's a good option for startups and investors.

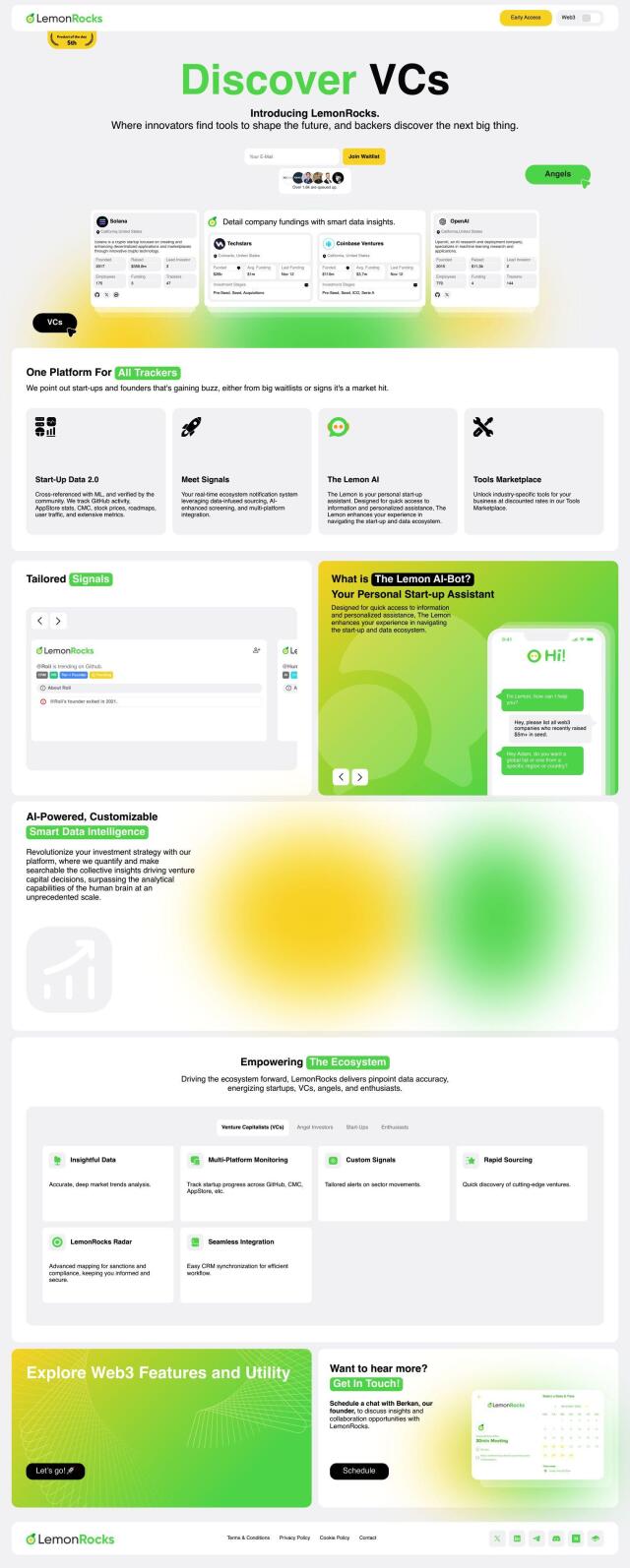

LemonRocks

If you prefer a data-driven approach, LemonRocks tracks startup activity and offers verified and cross-referenced data. It includes tools to track GitHub activity, AppStore statistics and other data, and alert systems to keep you up to date on the latest startup developments. It's customizable, offering targeted signals and insights to help you optimize growth.

Dili

Last, Dili is an AI-based deal platform for venture funds and private equity. It automates due diligence and analyst work, pulling data from multiple sources without requiring manual input. Dili offers private deal comps, custom reports and flags potential issues, so it can help you evaluate deals more thoroughly.