Question: I need a tool that helps me track my income and expenses across multiple bank accounts, can you suggest something?

COUNT

If you're looking for a tool to track income and expenses across multiple bank accounts, COUNT is a great option. This AI-powered accounting tool automates financial tasks and offers real-time insights and data visualization to help you make better decisions. It integrates with more than 12,000 financial institutions and offers features like real-time expense and income tracking, customizable dashboards and automated workflows. Pricing ranges from $29.99/month for small businesses to custom pricing for larger businesses.

Fortune App

Another top contender is the Fortune App, which automates, analyzes and forecasts your finances across multiple banks around the world. It supports connections to more than 17,000 banks globally and offers automated bank connections, automatic categorization, cash flow monitoring and multi-currency support. With a starting price of $10/month, it's affordable for basic analytics and more advanced features.

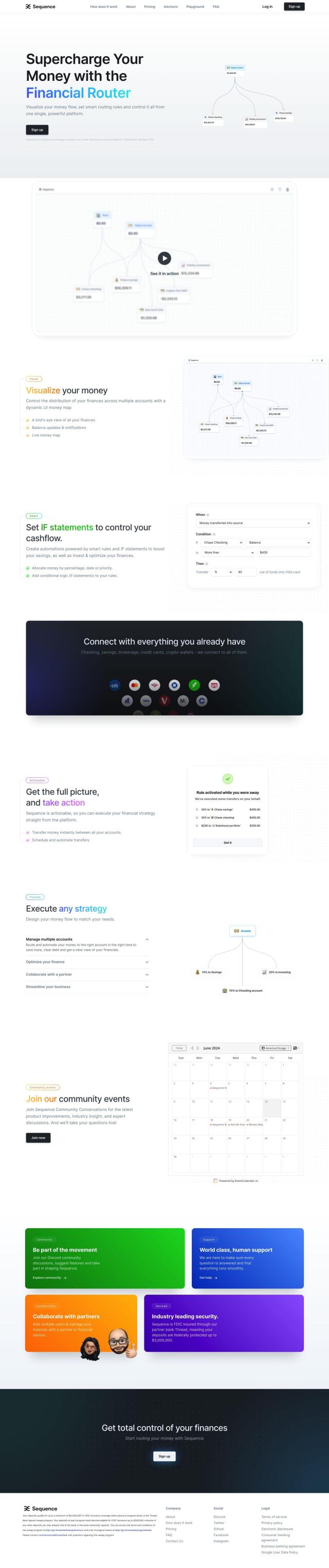

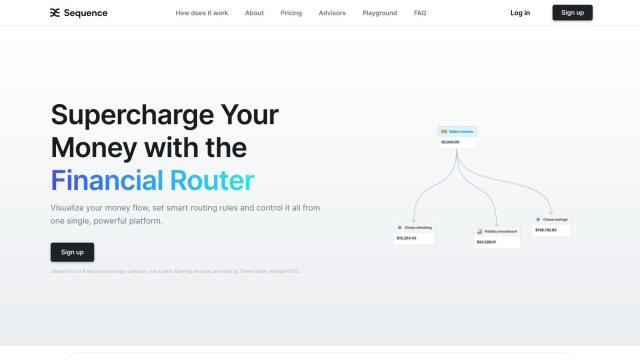

Sequence

Sequence is also worth a look, particularly if you want to automate and visualize your financial management. It can link multiple financial accounts, including checking and savings accounts, brokerage accounts and crypto wallets, and offers a dynamic UI money map that updates in real-time. You can automate tasks with custom rules and IF statements to optimize savings and investments, and the platform offers instant transfers and industry-leading security. Pricing is tiered depending on your needs.

Midday

Last is Midday, which is geared for freelancers and micro businesses, with support for more than 20,000 banks in 33 countries. It tracks income and expenses, offers advanced project tracking, and includes features like web-based invoicing, automatic invoice matching and secure file storage. The platform is built on open-source principles and offers AI-powered insights into financial situations, making it a good option for managing your finances and projects.